false0000764065DEF 14A00007640652023-01-012023-12-31iso4217:USD00007640652022-01-012022-12-3100007640652021-01-012021-12-3100007640652020-01-012020-12-310000764065ecd:PeoMemberclf:SCTPensionMember2023-01-012023-12-310000764065ecd:NonPeoNeoMemberclf:SCTPensionMember2023-01-012023-12-310000764065ecd:PeoMemberclf:SCTPensionMember2022-01-012022-12-310000764065ecd:NonPeoNeoMemberclf:SCTPensionMember2022-01-012022-12-310000764065ecd:PeoMemberclf:SCTPensionMember2021-01-012021-12-310000764065ecd:NonPeoNeoMemberclf:SCTPensionMember2021-01-012021-12-310000764065ecd:PeoMemberclf:SCTPensionMember2020-01-012020-12-310000764065ecd:NonPeoNeoMemberclf:SCTPensionMember2020-01-012020-12-310000764065ecd:PeoMemberclf:PensionCurrentYearServiceCostMember2023-01-012023-12-310000764065clf:PensionCurrentYearServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065ecd:PeoMemberclf:PensionCurrentYearServiceCostMember2022-01-012022-12-310000764065clf:PensionCurrentYearServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065ecd:PeoMemberclf:PensionCurrentYearServiceCostMember2021-01-012021-12-310000764065clf:PensionCurrentYearServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065ecd:PeoMemberclf:PensionCurrentYearServiceCostMember2020-01-012020-12-310000764065clf:PensionCurrentYearServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000764065ecd:PeoMemberclf:PensionPriorYearServiceCostImpactingCurrentYearMember2023-01-012023-12-310000764065clf:PensionPriorYearServiceCostImpactingCurrentYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065ecd:PeoMemberclf:PensionPriorYearServiceCostImpactingCurrentYearMember2022-01-012022-12-310000764065clf:PensionPriorYearServiceCostImpactingCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065ecd:PeoMemberclf:PensionPriorYearServiceCostImpactingCurrentYearMember2021-01-012021-12-310000764065clf:PensionPriorYearServiceCostImpactingCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065ecd:PeoMemberclf:PensionPriorYearServiceCostImpactingCurrentYearMember2020-01-012020-12-310000764065clf:PensionPriorYearServiceCostImpactingCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000764065ecd:PeoMemberclf:PensionMember2023-01-012023-12-310000764065ecd:NonPeoNeoMemberclf:PensionMember2023-01-012023-12-310000764065ecd:PeoMemberclf:PensionMember2022-01-012022-12-310000764065ecd:NonPeoNeoMemberclf:PensionMember2022-01-012022-12-310000764065ecd:PeoMemberclf:PensionMember2021-01-012021-12-310000764065ecd:NonPeoNeoMemberclf:PensionMember2021-01-012021-12-310000764065ecd:PeoMemberclf:PensionMember2020-01-012020-12-310000764065ecd:NonPeoNeoMemberclf:PensionMember2020-01-012020-12-310000764065ecd:PeoMemberclf:GrantDateValuesInTheSCTMember2023-01-012023-12-310000764065clf:GrantDateValuesInTheSCTMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065ecd:PeoMemberclf:GrantDateValuesInTheSCTMember2022-01-012022-12-310000764065clf:GrantDateValuesInTheSCTMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065ecd:PeoMemberclf:GrantDateValuesInTheSCTMember2021-01-012021-12-310000764065clf:GrantDateValuesInTheSCTMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065ecd:PeoMemberclf:GrantDateValuesInTheSCTMember2020-01-012020-12-310000764065clf:GrantDateValuesInTheSCTMemberecd:NonPeoNeoMember2020-01-012020-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:PeoMember2023-01-012023-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:PeoMember2022-01-012022-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:PeoMember2021-01-012021-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:PeoMember2020-01-012020-12-310000764065clf:YearEndFairValueOfUnvestedAwardsGrantedInTheCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2023-01-012023-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2022-01-012022-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2021-01-012021-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:PeoMember2020-01-012020-12-310000764065clf:YearOverYearDifferenceOfYearEndFairValuesForUnvestedAwardsGrantedInPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310000764065ecd:PeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2023-01-012023-12-310000764065ecd:NonPeoNeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2023-01-012023-12-310000764065ecd:PeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2022-01-012022-12-310000764065ecd:NonPeoNeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2022-01-012022-12-310000764065ecd:PeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2021-01-012021-12-310000764065ecd:NonPeoNeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2021-01-012021-12-310000764065ecd:PeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2020-01-012020-12-310000764065ecd:NonPeoNeoMemberclf:FairValuesAtVestDateForAwardsGrantedAndVestedInCurrentYearMember2020-01-012020-12-310000764065ecd:PeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2023-01-012023-12-310000764065ecd:NonPeoNeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2023-01-012023-12-310000764065ecd:PeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2022-01-012022-12-310000764065ecd:NonPeoNeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2022-01-012022-12-310000764065ecd:PeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2021-01-012021-12-310000764065ecd:NonPeoNeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2021-01-012021-12-310000764065ecd:PeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2020-01-012020-12-310000764065ecd:NonPeoNeoMemberclf:DifferencesInFairValuesBetweenPriorYearEndFairValuesAndVestDateFairValuesForAwardsGrantedInPriorYearsMember2020-01-012020-12-310000764065ecd:PeoMemberclf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMember2023-01-012023-12-310000764065clf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065ecd:PeoMemberclf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMember2022-01-012022-12-310000764065clf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065ecd:PeoMemberclf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMember2021-01-012021-12-310000764065clf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065ecd:PeoMemberclf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMember2020-01-012020-12-310000764065clf:ForfeituresDuringCurrentYearEqualToPriorYearEndFairValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000764065ecd:PeoMemberclf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMember2023-01-012023-12-310000764065clf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065ecd:PeoMemberclf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMember2022-01-012022-12-310000764065clf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065ecd:PeoMemberclf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMember2021-01-012021-12-310000764065clf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065ecd:PeoMemberclf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMember2020-01-012020-12-310000764065clf:DividendsOrDividendEquivalentsNotOtherwiseIncludedInTheTotalCompensationMemberecd:NonPeoNeoMember2020-01-012020-12-310000764065ecd:PeoMemberclf:EquityAwardsMember2023-01-012023-12-310000764065clf:EquityAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000764065ecd:PeoMemberclf:EquityAwardsMember2022-01-012022-12-310000764065clf:EquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000764065ecd:PeoMemberclf:EquityAwardsMember2021-01-012021-12-310000764065clf:EquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000764065ecd:PeoMemberclf:EquityAwardsMember2020-01-012020-12-310000764065clf:EquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-31000076406512023-01-012023-12-31000076406522023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ___)

| | | | | | | | | | | | | | | | | |

| ☒ | Filed by the Registrant | | | ☐ | Filed by a Party other than the Registrant |

| | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CLEVELAND-CLIFFS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| LETTER TO OUR SHAREHOLDERS |

|

|

April 3, 2024

Dear Fellow Cleveland-Cliffs Shareholders:

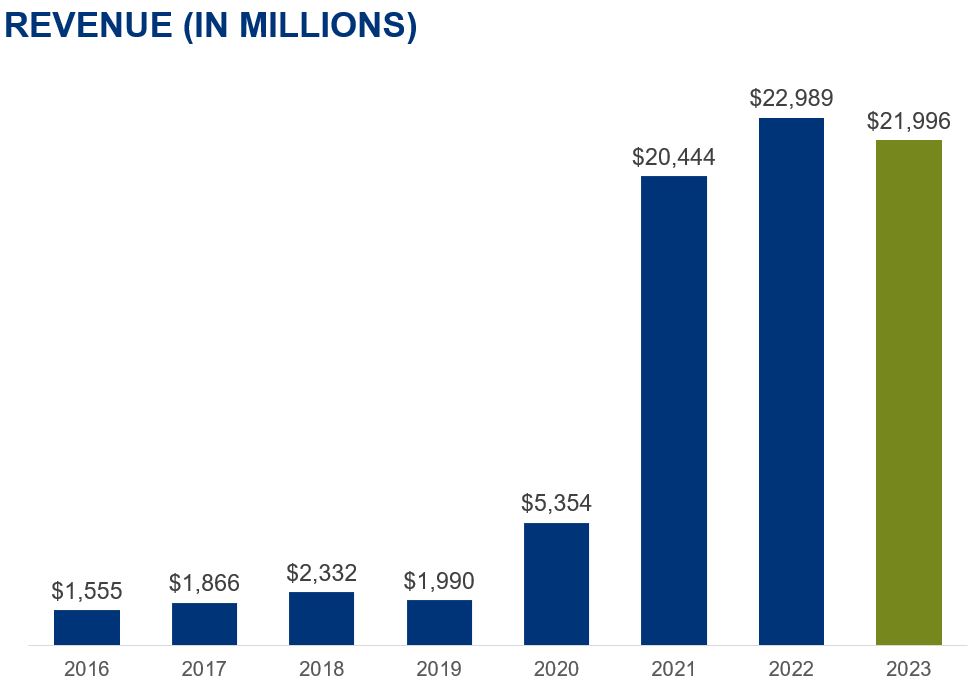

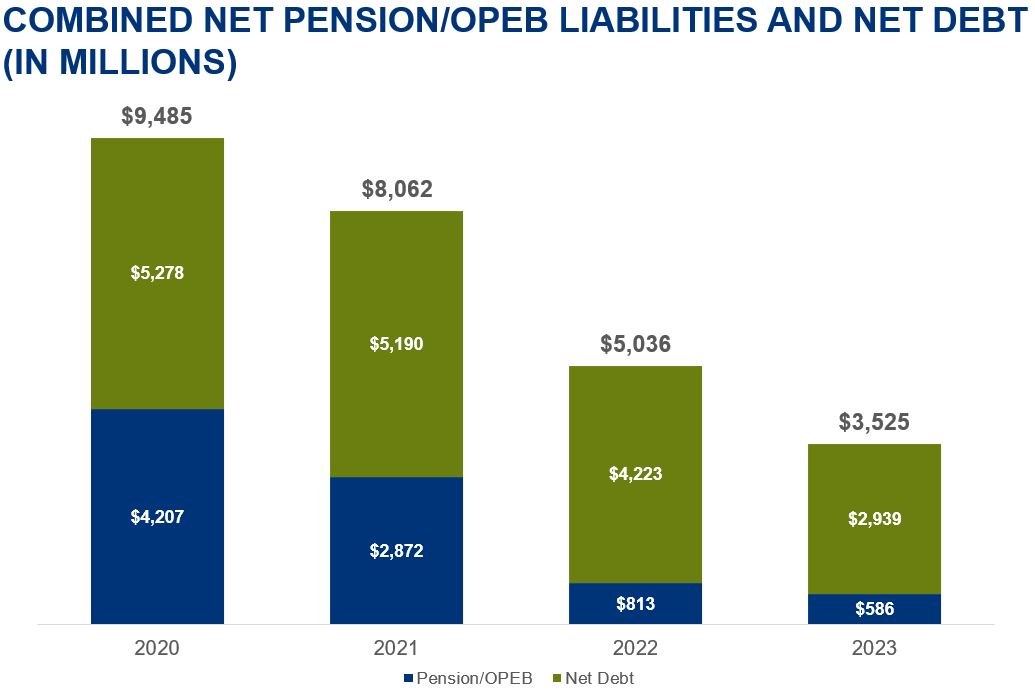

2023 was an outstanding year for Cleveland-Cliffs. The substantial free cash flow of more than $1.6 billion generated in 2023 allowed us to achieve our debt target by reaching a net debt level of $2.9 billion by year end. With that behind us, we now have the flexibility to return more capital to our shareholders, while pursuing value-enhancing M&A opportunities.

Steel demand remained healthy throughout the entire year, especially with our most important market, the automotive sector. From Cleveland-Cliffs’ standpoint, the UAW labor strike during the second half of the year was a non-event, and we delivered record shipments to the automotive industry. Besides automotive, we reaped the benefits of the maintenance improvements we executed in 2022 and delivered record total shipments of 16.4 million tons. The strong tonnage produced and sold allowed us to reduce our steelmaking costs without sacrificing our high-end product mix which, differently from every other steelmaker in the United States, includes significant tonnages of stainless and electrical steels, as well as a richer mix of complex specs of automotive-grade steels.

We also began to implement the CLIFFS H™ surcharge for steel produced through our blast furnace-basic oxygen furnace (BF-BOF) route, using our hot-briquetted iron (HBI) as blast furnace feedstock. We are proud to be able to supply our customers with this lower carbon intensive steel with the first true green premium used in the marketplace, CLIFFS H™. With the CLIFFS H™ steel surcharge, we were able to monetize our environmental gains and our significant reduction in CO2 emissions achieved over the last several years.

Cleveland-Cliffs has also demonstrated how far ahead we are in ironmaking and steelmaking, when compared against Europe, Japan, China or South Korea, among all others. We have successfully completed real life trials of hydrogen injection into blast furnaces as a reductant and fuel source at two of our integrated steel mills, Indiana Harbor and Middletown Works, and we also installed a hydrogen pipeline at Indiana Harbor in anticipation of the future U.S. Department of Energy (DOE) hydrogen hub in Indiana. We are ahead of the rest of the world in using proven technologies that make our blast furnace steel the cleanest in the world, including using iron ore pellets, natural gas injection, HBI, and now hydrogen. We will continue to drive reductions in our carbon footprint through our lower emissions initiatives and opportunities, as we reshape the future of ironmaking and steelmaking in this country. In 2023, the DOE recognized Cleveland-Cliffs for our decarbonization performance, and we remain the only steel company included in its Better Buildings Initiative and Better Climate Challenge. On the horizon is the use of hydrogen as an optimal energy source and reductant to further decarbonize our steelmaking process.

We are responsible stewards of the resources that we control and operate in our hometown communities in the heartland of the United States. Our success has made us even stronger as an American owned and operated iron and steel company. We will continue to develop and bring to market high-value steel solutions that meet or exceed the expectations of our customers.

As we grow, we retain our strong commitment to maintaining a safe work environment for our 28,000 employees. I thank all of our employees, particularly our union workforce, for their continued dedication to safe production. Through our established relationship with our unions, we will continue to work in partnership to accomplish our goals together. We are well positioned to support good-paying, middle class jobs for our workers, develop critical solutions for our customers, advance lower-carbon steel solutions and, as a direct consequence of all that, reward our shareholders.

I appreciate your confidence and your continued support.

Sincerely,

Lourenco Goncalves

Chairman, President and Chief Executive Officer

| | |

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

|

|

To Be Held on May 16, 2024

11:30 a.m. EDT

Online at www.virtualshareholdermeeting.com/CLF2024

To the Shareholders of Cleveland-Cliffs Inc.:

The 2024 Annual Meeting of Shareholders of Cleveland-Cliffs Inc. will be held in a virtual meeting format via live audio webcast on the Internet at www.virtualshareholdermeeting.com/CLF2024, at 11:30 a.m. EDT, on Thursday, May 16, 2024, for the following purposes:

1.To elect as directors the ten candidates nominated by the Board of Directors to act until the next Annual Meeting of Shareholders or until their respective successors are duly elected and qualified;

2.To approve, on an advisory basis, our named executive officers’ compensation;

3.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2024 fiscal year; and

4.To transact such other business, if any, as may properly come before the 2024 Annual Meeting or any adjournment thereof.

In order to vote on the matters brought before the 2024 Annual Meeting, you may vote via the Internet, vote by telephone, complete and mail the proxy card, or vote online during the 2024 Annual Meeting, as explained on the proxy card. To participate in the 2024 Annual Meeting at www.virtualshareholdermeeting.com/CLF2024, you must enter the 16-digit control number found on your proxy card or your voting instruction form. You do not need to attend the virtual meeting in order to vote your shares.

Holders of record of our common shares at the close of business on March 18, 2024 are entitled to notice of, and to vote at, the 2024 Annual Meeting or any adjournments thereof.

By Order of the Board of Directors,

James D. Graham

Executive Vice President, Chief Legal and Administrative Officer & Secretary

April 3, 2024

Cleveland, Ohio

| | | | | | | | |

YOUR VOTE IS IMPORTANT. YOU MAY VOTE BY INTERNET, BY TELEPHONE, BY MAILING THE ENCLOSED PROXY CARD, OR BY VOTING ONLINE DURING THE 2024 ANNUAL MEETING. |

The proxy statement and Cliffs’ 2023 Annual Report for the 2023 fiscal year are available at www.proxyvote.com. These materials also are available on Cliffs’ website at www.clevelandcliffs.com under “Investors.” If your shares are not registered in your own name, please follow the voting instructions from your bank, broker, nominee or other shareholder of record to vote your shares. |

| | |

| PROXY STATEMENT TABLE OF CONTENTS |

|

|

| | | | | |

| PROXY STATEMENT SUMMARY | |

| QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING | |

| MEETING INFORMATION | |

| ENVIRONMENTAL, SOCIAL, GOVERNANCE AND SUSTAINABILITY | |

| CORPORATE GOVERNANCE | |

| Board Leadership Structure | |

| Board’s Role in Risk Oversight | |

| Board Meetings and Committees | |

| Identification and Evaluation of Director Candidates | |

| Communications With Directors | |

| Code of Business Conduct and Ethics | |

| Independence and Related Party Transactions | |

| DIRECTOR COMPENSATION | |

Director Compensation for 2023 | |

| PROPOSAL 1 – ELECTION OF DIRECTORS | |

| Information Concerning Director Nominees | |

| OWNERSHIP OF EQUITY SECURITIES OF THE COMPANY | |

| EQUITY COMPENSATION PLAN INFORMATION | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

| Executive Summary | |

| Executive Compensation Philosophy and Core Principles | |

| Development and Oversight of Executive Compensation | |

| Analysis of 2023 Compensation Decisions | |

| Retirement and Deferred Compensation Benefits | |

| Supplementary Compensation Policies | |

| |

| | | | | |

| |

| COMPENSATION COMMITTEE REPORT | |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | |

| COMPENSATION-RELATED RISK ASSESSMENT | |

| EXECUTIVE COMPENSATION TABLES | |

| Executive Compensation Tables and Narratives | |

| Potential Payments Upon Termination or Change in Control | |

| CEO Pay Ratio | |

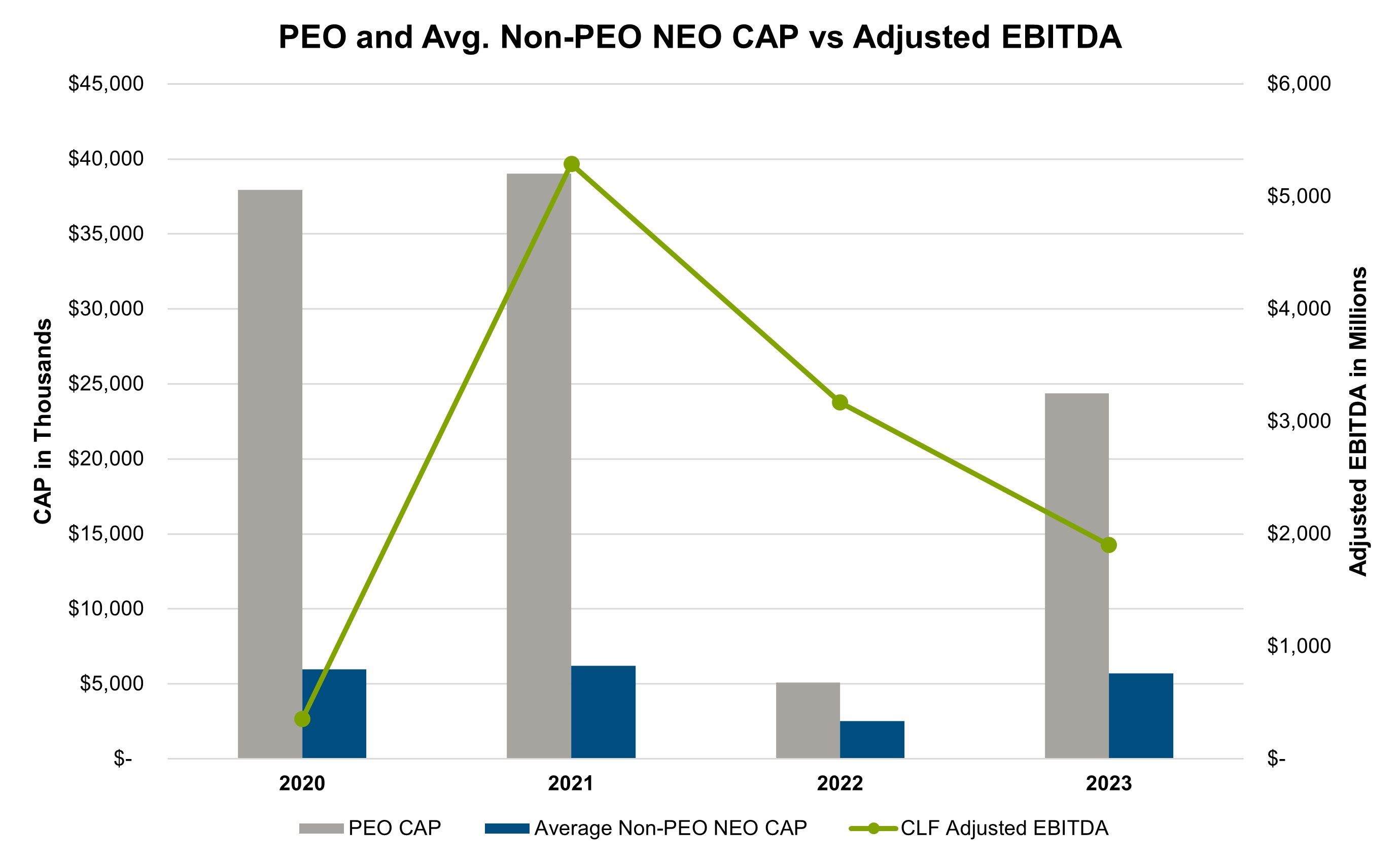

| Pay Versus Performance | |

| PROPOSAL 2 – APPROVAL, ON AN ADVISORY BASIS, OF OUR NAMED EXECUTIVE OFFICERS' COMPENSATION | |

| AUDIT COMMITTEE REPORT | |

| PROPOSAL 3 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| INFORMATION ABOUT SHAREHOLDER PROPOSALS AND COMPANY DOCUMENTS | |

| OTHER INFORMATION | |

| ANNEX A | |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find further information. Throughout this proxy statement, Cleveland-Cliffs Inc. is referred to as “Cleveland-Cliffs,” “Cliffs,” “the Company,” “we,” “us,” “our” and similar expressions.

| | | | | | | | |

2024 ANNUAL MEETING OF SHAREHOLDERS | |

| |

DATE AND TIME: | Thursday, May 16, 2024, at 11:30 a.m. EDT |

PLACE: | Online at www.virtualshareholdermeeting.com/CLF2024 |

RECORD DATE: | March 18, 2024 |

VOTING: | Shareholders of record are entitled to vote by Internet at www.proxyvote.com; by telephone at 1-800-690-6903; by completing and returning the enclosed proxy card by mail; or by voting online during the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”) at www.virtualshareholdermeeting.com/CLF2024 (beneficial holders must obtain a legal proxy from their broker, bank, nominee or other shareholder of record granting the right to vote). |

PROXY MATERIALS: | This proxy statement, the accompanying proxy card and our 2023 Annual Report will be made available on or about April 3, 2024 to shareholders of record as of March 18, 2024. |

| | | | | |

ATTENDANCE AND PARTICIPATION AT THE 2024 ANNUAL MEETING | |

| |

Our virtual 2024 Annual Meeting will be conducted on the Internet via live audio webcast. Shareholders will be able to participate online and submit questions in advance of the 2024 Annual Meeting by visiting www.virtualshareholdermeeting.com/CLF2024, beginning at 11:00 a.m. EDT on May 16, 2024. Shareholders will be able to vote their shares electronically during the 2024 Annual Meeting. To participate in the 2024 Annual Meeting, you will need the 16-digit control number included on your proxy card or your voting instruction form. The 2024 Annual Meeting will begin promptly at 11:30 a.m. EDT. We encourage you to access the 2024 Annual Meeting prior to the start time. Online access will begin at 11:00 a.m. EDT. Guests may listen to a live audio webcast of the virtual 2024 Annual Meeting by visiting www.virtualshareholdermeeting.com/CLF2024, but guests are not entitled to participate. The virtual 2024 Annual Meeting platform is fully supported across browsers (Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and smartphones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet connection wherever they intend to participate in the 2024 Annual Meeting. Participants should also allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the 2024 Annual Meeting. To ensure your shares are properly represented, please vote your proxy promptly even if you plan to join the 2024 Annual Meeting. QUESTIONS At the conclusion of the 2024 Annual Meeting, Lourenco Goncalves, our Chairman, President and Chief Executive Officer (“CEO”), will be available to answer questions submitted by shareholders. Shareholders may submit questions for the 2024 Annual Meeting after logging in, beginning at 11:00 a.m. EDT on May 16, 2024. If you wish to submit a question, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/CLF2024, typing your question into the “Ask a Question” field, and clicking “Submit.” Please submit any questions before the start time of the 2024 Annual Meeting. We will answer as many shareholder-submitted questions as time permits. Additional information regarding the ability of shareholders to ask questions during the 2024 Annual Meeting, related rules of conduct and other materials for the 2024 Annual Meeting will be available at www.virtualshareholdermeeting.com/CLF2024. TECHNICAL DIFFICULTIES Technical support, including related technical support phone numbers, will be available on the virtual meeting platform at www.virtualshareholdermeeting.com/CLF2024 beginning at 11:00 a.m. EDT on May 16, 2024 through the conclusion of the 2024 Annual Meeting. |

1 | CLF 2024 PROXY STATEMENT

| | | | | | | | | | | |

VOTING MATTERS | BOARD VOTE RECOMMENDATION | PAGE REFERENCE (for more detail) |

|

| | |

Proposal 1 | Election of Directors | FOR ALL Director Nominees | |

Proposal 2 | Approval, on an Advisory Basis, of Our Named Executive Officers’ Compensation (“Say-on-Pay”) | FOR | |

Proposal 3 | Ratification of Independent Registered Public Accounting Firm | FOR | |

| | | | | | | | | | | | | | | | | |

DIRECTOR NOMINEES RECOMMENDED BY THE BOARD | |

|

| NAME | AGE | DIRECTOR SINCE | POSITION | COMMITTEE MEMBERSHIPS (1) |

| Lourenco Goncalves | 66 | 2014 | Chairman of the Board, President and

Chief Executive Officer | Strategy and Sustainability* |

| Douglas C. Taylor | 59 | 2014 | Lead Director | Compensation*

Strategy and Sustainability |

| John T. Baldwin | 67 | 2014 | Director | Audit*

Compensation |

| Ron A. Bloom | 69 | 2024 | Director | Governance

Strategy and Sustainability |

| Susan M. Green | 64 | 2007 | Director | Governance |

| Ralph S. Michael, III | 69 | 2020 | Director | Governance*

Compensation |

| Janet L. Miller | 70 | 2019 | Director | Governance |

| Ben Oren | 44 | N/A | Director Nominee | Audit** |

| Gabriel Stoliar | 70 | 2014 | Director | Strategy and Sustainability |

| Arlene M. Yocum | 66 | 2020 | Director | Audit

Strategy and Sustainability |

* Committee chair ** Proposed committee assignment (1)Full committee names are: Audit – Audit Committee; Compensation – Compensation and Organization Committee; Governance – Governance and Nominating Committee; and Strategy and Sustainability – Strategy and Sustainability Committee.

|

| | | | | |

SHAREHOLDER ENGAGEMENT (summary) | |

| |

| We maintain open and proactive communications with the investment community. During 2023 and early 2024, we reached out to our top 25 shareholders, representing approximately 44% of our outstanding common shares (approximately 55% of the votes cast at our 2023 Annual Meeting of Shareholders), to solicit their perspectives on our compensation program, financial performance, corporate governance, sustainability and other topics. These discussions included our independent Lead Director when requested. The feedback received from our outreach efforts is shared with and considered by our Board of Directors (the “Board”), and our engagement activities have generated valuable input that helps inform our decisions and strategy, when appropriate. See the section entitled “Shareholder Engagement” in the Compensation Discussion and Analysis (“CD&A”) section for more details as to what we heard from our recent engagement activities and how we responded to that feedback. |

2 | CLF 2024 PROXY STATEMENT

| | | | | |

EXECUTIVE COMPENSATION PHILOSOPHY AND CORE PRINCIPLES | |

| |

Our guiding executive compensation principles, as established by the Compensation Committee for 2023, were as follows: 1.Align short-term and long-term incentives with results delivered to shareholders; 2.Be transparent, helping to ensure that executives and shareholders understand our executive compensation programs, including the objectives, mechanics, compensation levels and opportunities provided; 3.Design an incentive plan that focuses on performance objectives tied to our business plan (including profitability-related and cost control objectives), relative performance objectives tied to market conditions (including relative total shareholder return, measured by share price appreciation plus dividends, if any) and performance against other key objectives tied to our business strategy (including safety); 4.Provide competitive fixed compensation elements over the short term (base salary) and long term (equity and retirement benefits) to encourage long-term retention of our key executives; and 5.Continue to structure programs to align with corporate governance best practices (such as not providing “gross-ups” related to change in control payments, using “double-trigger” vesting in connection with a change in control for equity awards, using Share Ownership Guidelines and maintaining a clawback policy related to incentive compensation for our executive officers). |

| | | | | |

2023 EXECUTIVE COMPENSATION SUMMARY | |

| |

The numbers in the following table showing the 2023 compensation of our named executive officers (the “NEOs”) were determined in the same manner as the numbers in the corresponding columns in the 2023 Summary Compensation Table (the “SCT”) (provided later in this proxy statement); however, they do not include information regarding changes in pension value and non-qualified deferred compensation earnings and information regarding all other compensation, each as required to be presented in the SCT under the rules of the U.S. Securities and Exchange Commission (the “SEC”). As such, this table should not be viewed as a substitute for the SCT. |

| | | | | | | | | | | | | | | | | | | | | | | |

| NAME | PRINCIPAL POSITION (AS OF 12/31/2023) | SALARY

($) | BONUS

($) | STOCK AWARDS

($) | OPTION AWARDS ($) | NON-EQUITY INCENTIVE PLAN COMPENSATION

($) | TOTAL

($) |

| Lourenco Goncalves | Chairman, President and Chief Executive Officer | 2,116,000 | | — | | 11,860,431 | | — | | 10,150,235 | | 24,126,666 | |

| Celso L. Goncalves Jr. | Executive Vice President, Chief Financial Officer | 750,000 | | — | | 3,152,903 | | — | | 1,555,254 | | 5,458,157 | |

| Clifford T. Smith | Executive Vice President & President, Cleveland-Cliffs Steel | 859,000 | | — | | 3,611,091 | | — | | 2,479,086 | | 6,949,177 | |

| Keith A. Koci | Executive Vice President & President, Cleveland-Cliffs Services | 710,000 | | — | | 2,984,710 | | — | | 1,921,479 | | 5,616,189 | |

| James D. Graham | Executive Vice President, Human Resources, Chief Legal and Administrative Officer & Secretary | 681,000 | | — | | 2,544,728 | | — | | 1,598,460 | | 4,824,188 | |

| | | | | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2024. |

| | | | | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| |

| This proxy statement contains statements that constitute “forward-looking statements” within the meaning of the federal securities laws. As a general matter, forward-looking statements relate to anticipated trends and expectations rather than historical matters. Forward-looking statements are subject to uncertainties and factors relating to our operations and business environment that are difficult to predict and may be beyond our control. Such uncertainties and factors may cause actual results to differ materially from those expressed or implied by the forward-looking statements. These factors and uncertainties include, but are not limited to, the factors, risks and uncertainties described in Part I., Item 1A., “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2023, and those described from time to time in our future reports filed with the SEC. Except to the extent required by law, we do not undertake to update the forward-looking statements included in this proxy statement to reflect the impact of circumstances or events that may arise after the date the forward-looking statements were made. Forward-looking and other statements in this proxy statement regarding our greenhouse gas (“GHG”) reduction plans and goals are not an indication that these statements are necessarily material to investors or required to be disclosed in our filings with the SEC. In addition, historical, current and forward-looking GHG-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve and assumptions that are subject to change in the future. |

3 | CLF 2024 PROXY STATEMENT

| | |

| QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING |

|

|

1. What proposals are to be presented at the 2024 Annual Meeting?

The purpose of the 2024 Annual Meeting is to: (1) elect the ten directors nominated by the Board in this proxy statement; (2) approve, on an advisory basis, our NEOs’ compensation; (3) ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2024 fiscal year; and (4) conduct such other business as may properly come before the 2024 Annual Meeting.

2. What is the difference between a “shareholder of record” and a “beneficial owner”?

These terms describe the manner in which your shares are held. If your shares are registered directly in your name through Broadridge, our transfer agent, then you are the registered holder, or “shareholder of record." If your shares are held through a bank, broker, nominee or other shareholder of record, then you are considered the “beneficial owner” of those shares.

3. How does the Board recommend that I vote?

The Board unanimously recommends that you vote:

•FOR ALL of the ten individuals nominated by the Board for election as directors;

•FOR the approval, on an advisory basis, of our NEOs’ compensation; and

•FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2024 fiscal year.

4. Who is entitled to vote at the 2024 Annual Meeting?

The record date for the 2024 Annual Meeting is March 18, 2024 (the “Record Date”). On the Record Date, we had outstanding 475,458,421 common shares, $0.125 par value per share. All common shareholders of record as of the Record Date are entitled to vote at the 2024 Annual Meeting. In this proxy statement, we refer to our common shares as our "shares" and the holders of such shares as our "shareholders."

5. How do I vote?

You may vote using any of the following methods:

Shareholders of Record. If your shares are registered in your name, you may vote online during the virtual 2024 Annual Meeting at www.virtualshareholdermeeting.com/CLF2024 or you may vote by proxy. If you decide to vote by proxy, you may do so over the Internet, by telephone or by mail.

•Over the Internet. After reading the proxy materials and with your proxy card in front of you, you may use a computer to access the website www.proxyvote.com. You will be prompted to enter your control number from your proxy card. This number will identify you as a shareholder of record. Follow the simple instructions that will be given to you to record your vote.

•By telephone. After reading the proxy materials and with your proxy card in front of you, you may call the toll-free number appearing on the proxy card, using a touch-tone telephone. You will be prompted to enter your control number from your proxy card. This number will identify you as a shareholder of record. Follow the simple instructions that will be given to you to record your vote.

•By mail. If you received a paper copy of the proxy card by mail, after reading the proxy materials, you may mark, sign and date your proxy card and return it in the prepaid and addressed envelope provided.

The Internet and telephone voting procedures have been set up for your convenience and have been designed to authenticate your identity, allow you to submit voting instructions and confirm that those instructions have been recorded properly.

Shares Held by Bank, Broker, Nominee or Other Shareholder of Record. If your shares are held by a bank, broker, nominee or other shareholder of record, that entity will provide you with separate voting instructions. All nominee share interests may view the proxy materials using the link www.proxyvote.com.

If your shares are held in the name of a brokerage firm, your shares may be voted on certain proposals presented at the 2024 Annual Meeting even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under applicable rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from

4 | CLF 2024 PROXY STATEMENT

the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is referred to as a “broker non-vote.” The ratification of Deloitte & Touche LLP as our registered independent public accounting firm is considered a routine matter for which a brokerage firm that holds your shares may vote your shares without your instructions. The election of directors and the approval, on an advisory basis, of our NEOs' compensation are not considered routine matters, and, therefore, a brokerage firm that holds your shares may not vote your shares for such proposals without your instructions.

6. What can I do if I change my mind after I vote?

You may revoke your proxy at any time before the polls are closed for voting at the 2024 Annual Meeting by: (i) executing and submitting a revised proxy bearing a later date; (ii) providing a written revocation to the Secretary of Cliffs; or (iii) voting online during the virtual 2024 Annual Meeting at www.virtualshareholdermeeting.com/CLF2024. If you do not hold your shares directly, you should follow the instructions provided by your bank, broker, nominee or other shareholder of record to revoke your previously voted proxy.

7. What vote is required to approve each proposal?

With respect to Proposal 1, the nominees receiving a plurality vote of the shares will be elected. However, under our majority voting policy (adopted by the Board), in an uncontested election, any director-nominee that is elected by a plurality vote but fails to receive a majority of the votes cast (excluding abstentions and broker non-votes) is expected to tender his or her resignation, which resignation will be considered by the Governance Committee and the Board.

With respect to Proposal 2, approval, on an advisory basis, of our NEOs’ compensation requires the affirmative vote of a majority of the shares present, in person or represented by proxy, at the 2024 Annual Meeting and entitled to vote on the proposal.

With respect to Proposal 3, the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the 2024 fiscal year will pass with the affirmative vote of a majority of the shares present, in person or represented by proxy, at the 2024 Annual Meeting and entitled to vote on the proposal.

8. Can I attend the 2024 Annual Meeting in person?

The 2024 Annual Meeting will be held exclusively online, with no option to attend in person. If you plan to attend the 2024 Annual Meeting virtually, you will need to visit www.virtualshareholdermeeting.com/CLF2024 and use your 16-digit control number to log into the meeting. If you do not have a 16-digit control number, you may still attend the virtual 2024 Annual Meeting as a guest in listen-only mode. We encourage shareholders to log into the website and access the webcast early, beginning approximately 30 minutes before the 11:30 a.m. EDT start time. If you experience technical difficulties, please contact the technical support telephone number posted on www.virtualshareholdermeeting.com/CLF2024.

5 | CLF 2024 PROXY STATEMENT

The accompanying proxy is solicited by the Board for use at the 2024 Annual Meeting and any adjournments or postponements thereof. This proxy statement, the accompanying proxy card, and our 2023 Annual Report will be made available on or about April 3, 2024 to our shareholders of record as of the Record Date.

PROXY MATERIALS

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with rules adopted by the SEC, we are using the Internet as our primary means of furnishing proxy materials to our shareholders. Accordingly, most shareholders will not receive paper copies of our proxy materials.

We will instead send our shareholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials and voting electronically over the Internet or by telephone, also known as Notice and Access. The notice also provides information on how shareholders may request paper copies of our proxy materials. We believe electronic delivery of our proxy materials will help us reduce the environmental impact and costs of printing and distributing paper copies and improve the speed and efficiency by which our shareholders can access these materials.

On or about April 3, 2024, we will mail to each shareholder of record as of the Record Date (other than those shareholders who previously had requested paper delivery of proxy materials) a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review the proxy materials, including this proxy statement and the 2023 Annual Report, on the Internet and how to access a proxy card to vote via the Internet or by telephone.

The close of business on March 18, 2024 has been fixed as the Record Date for the 2024 Annual Meeting, and only shareholders of record at that time will be entitled to vote.

The Notice of Internet Availability of Proxy Materials will contain a 16-digit control number that shareholders will need to access the proxy materials, to request paper or electronic copies of the proxy materials, and to vote their shares via the Internet or by telephone.

HOUSEHOLDING

We are permitted to send a single copy of the Notice of Internet Availability of Proxy Materials or set of proxy materials (if paper delivery was previously requested) to shareholders who share the same last name and address. This procedure is called “householding” and is designed to reduce our printing and postage costs and reduce our environmental impact by printing fewer paper copies. If you are the beneficial owner, but not the record holder, of Cliffs shares, your bank, broker, nominee or other shareholder of record may only deliver one copy of the Notice of Internet Availability of Proxy Materials or set of proxy materials and, as applicable, any other proxy materials that are made available until such time as you or other shareholders sharing your address notify your nominee that you wish to receive separate copies. Beneficial owners sharing an address who are receiving multiple copies of the Notice of Internet Availability of Proxy Materials or sets of proxy materials and who wish to receive a single copy or set in the future will need to contact their bank, broker, nominee or other shareholder of record. A shareholder who wishes to receive a separate copy of the Notice of Internet Availability of Proxy Materials or set of proxy materials, or shareholders who share the same address that are currently receiving multiple copies of the Notice of Internet Availability of Proxy Materials or sets of proxy materials and who wish to receive a single copy or set, either now or in the future, may submit this request by writing to our Secretary at Cleveland-Cliffs Inc., 200 Public Square, Suite 3300, Cleveland, Ohio 44114, or by calling our Investor Relations department at (800) 214-0739, and it will be delivered promptly.

PROXY SOLICITATION

We will bear the cost of solicitation of proxies. We have engaged Okapi Partners LLC to assist in the solicitation of proxies for fees and disbursements not expected to exceed approximately $65,000 in the aggregate. In addition, employees and representatives of the Company may solicit proxies, and we will request that banks and brokers or other similar agents or fiduciaries transmit the proxy materials to beneficial owners for their voting instructions, and we will reimburse them for their expenses in so doing.

VOTING RIGHTS

Shareholders of record on the Record Date are entitled to vote at the 2024 Annual Meeting. On the Record Date, there were outstanding 475,458,421 common shares entitled to vote at the 2024 Annual Meeting. A majority of the common shares entitled to vote must be represented at the 2024 Annual Meeting, in person or by proxy, to constitute a quorum and to transact business. Each outstanding share is entitled to one vote in connection with each item to be acted upon at the 2024 Annual Meeting. You may submit a proxy by electronic transmission via the Internet, by telephone or by mail, as explained on your proxy card.

6 | CLF 2024 PROXY STATEMENT

VOTING OF PROXIES

The common shares represented by properly authorized proxies will be voted as specified. It is intended that the shares represented by properly authorized proxies on which no specification has been made will be voted: (1) FOR ALL of the ten director nominees named herein or such substitute nominees as the Board may designate; (2) FOR the approval, on an advisory basis, of our NEOs' compensation; (3) FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2024 fiscal year; and (4) at the discretion of the persons named as proxies on all other matters that may properly come before the 2024 Annual Meeting.

CUMULATIVE VOTING FOR ELECTION OF DIRECTORS

If notice in writing shall be given by any shareholder to the President, an Executive Vice President or the Secretary of the Company, not less than 48 hours before the time fixed for the holding of the 2024 Annual Meeting, that such shareholder desires that the voting for the election of directors shall be cumulative, and if an announcement of the giving of such notice is made upon the convening of the 2024 Annual Meeting by the Chairman or Secretary or by or on behalf of the shareholder giving such notice, each shareholder shall have the right to cumulate such voting power as such shareholder possesses at such election. Under cumulative voting, a shareholder may cast for any one nominee as many votes as shall equal the number of directors to be elected, multiplied by the number of such shareholder's shares. All such votes may be cast for a single nominee or may be distributed among any two or more nominees as such shareholder may desire. If cumulative voting is invoked, and unless contrary instructions are given by a shareholder who signs a proxy, all votes represented by such proxy will be cast in such manner and in accordance with the discretion of the person acting as proxy as will result in the election of as many of the Board’s nominees as is possible.

COUNTING VOTES

The results of shareholder voting will be tabulated by the inspector of elections appointed for the 2024 Annual Meeting. We intend to treat properly authorized proxies as “present” for purposes of determining whether a quorum has been achieved at the 2024 Annual Meeting. Abstentions and broker non-votes will also be counted for purposes of determining whether a quorum is present.

Abstentions and broker non-votes will have no effect with respect to the election of directors. Abstentions will have the effect of votes against, and broker non-votes will have no effect with respect to, the advisory vote regarding the compensation of our NEOs. Abstentions will have the effect of votes against the ratification of Deloitte & Touche LLP as our independent registered public accounting firm. The ratification of Deloitte & Touche LLP as our independent registered public accounting firm is considered a routine matter and, as a result, we do not expect to have broker non-votes with respect to this proposal.

7 | CLF 2024 PROXY STATEMENT

| | |

| ENVIRONMENTAL, SOCIAL, GOVERNANCE AND SUSTAINABILITY |

|

|

OUR COMMITMENT TO SUSTAINABILITY

Cleveland-Cliffs remains committed to sustainable business practices and the pursuit of cleaner iron and steel making. Rooted in our Core Values outlined in our Code of Business Conduct and Ethics, we believe in doing business ethically and responsibly with a focus on good corporate governance. We are committed to creating a safe and positive working environment for our employees to grow personally and professionally, and we are proud to partner with our labor unions. We also invest in our host communities by fostering two-way dialogue and identifying tangible ways to give back. We continuously work to mitigate environmental impacts while conserving natural resources and evaluating opportunities to decarbonize our business for the long term.

STEEL FOR A SUSTAINABLE SOCIETY

Now more than ever, the American steel industry is a vital component in the transition to a low-carbon economy. We believe that efficient steel manufacturing will enable the decarbonization of many other industries as we collectively mitigate the impacts of climate change. Through our sustainable steel solutions, Cleveland-Cliffs is making sustainability and innovation in steel happen.

As a vertically integrated iron and steel company proudly manufacturing in the United States, we are uniquely positioned to meet customer needs with products that enable the mass adoption of electric vehicles and the production and transmission of clean energy. Through our environmentally friendly iron ore pellets to our lower-carbon hot briquetted iron (“HBI”) to our unique scrap processing capabilities, we create a closed-loop steel recycling system that produces quality and sustainable steel products on which our customers can rely.

In 2023, Cleveland-Cliffs introduced our Cliffs’ Steel Tubes As Reinforcement (“C-STAR™ protection”) product and our Cleveland-Cliffs Battery Enclosure (“battery box design”) for battery electric vehicles. Our C-STAR™ protection design was developed for the purpose of providing electric vehicle battery protection for improved safety purposes but can be used in any type of light vehicle. The all-steel battery box design utilizes various grades of advanced high-strength steel for improved use for lower GHG emissions, to maintain light-weighting targets and to gain cost benefits when compared to using alternative materials. The battery box design also enables a 70% reduction in CO2 emissions compared to an all-aluminum design.

We continue to utilize methods for emissions reduction, such as optimizing recycled content, while maintaining the product quality specifications our customers need. Through our wholly-owned subsidiary, Ferrous Processing and Trading Company, we source and process prime scrap to enable a closed-loop steel recycling business that allows us to optimize productivity at our furnaces. And with a limited supply of prime scrap, the most demanding steel grades need high-purity sources of iron, a demand that we can fulfill with our U.S.-based, vertically-integrated footprint of iron ore pellets and HBI.

ENVIRONMENTAL AND SUSTAINABILITY MANAGEMENT

Being a good corporate citizen with respect to the environment and our impact on local communities is critically important to our ability to maintain our social license to operate. Acting responsibly begins with a foundation of strong corporate governance and leadership. Our Strategy and Sustainability Committee, chaired by our Chairman, President and CEO, provides critical oversight of our strategic planning activities and long-term business objectives, as well as the implementation of our sustainability strategy, which includes review of major environmental, social and governance (“ESG”) risks and opportunities. Our Executive Vice President, Environmental & Sustainability, is responsible for the environmental compliance and sustainability functions of our business and leads collaborative efforts across our operating footprint to ensure that all relevant departments within our Company are engaged in supporting our sustainability initiatives, including those concerning climate-related risks and opportunities. We work to ensure compliance with applicable environmental permits and regulatory requirements and maintain a high certification rate for ISO 14001. We also invest capital in environmental projects to maintain our social license to operate, continuously strive to employ best available technologies and reflect a positive reputation in our local communities.

8 | CLF 2024 PROXY STATEMENT

ENVIRONMENTAL, SOCIAL, GOVERNANCE AND SUSTAINABILITY

CLIMATE AND GREENHOUSE GAS EMISSIONS

Building off past success, Cleveland-Cliffs continued to focus on GHG emissions reductions in 2023. Throughout the year, we engaged with partners for our future decarbonization strategy, including supporting research and development of lower carbon iron and steelmaking technologies and products to help reduce emissions across our society.

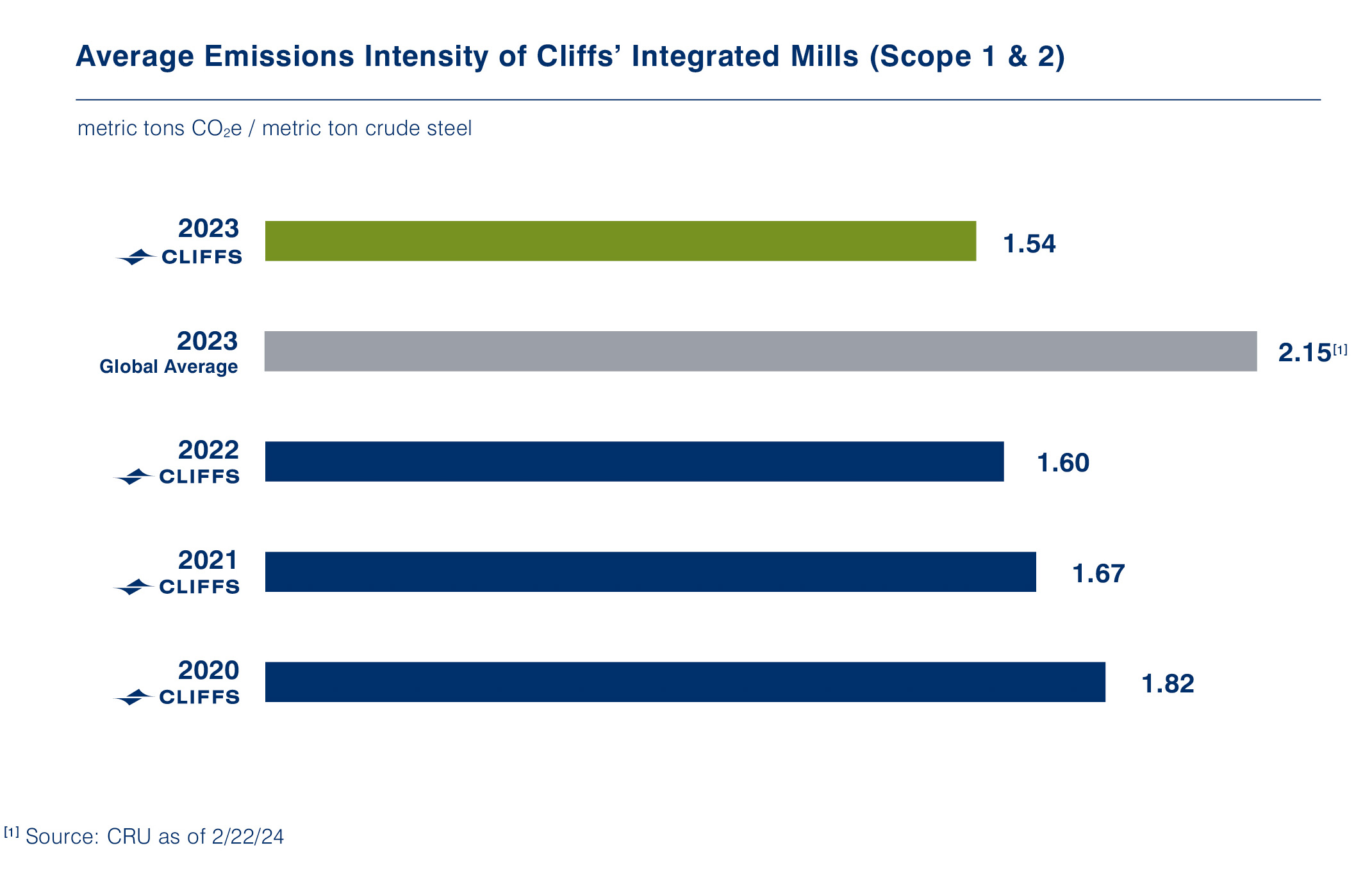

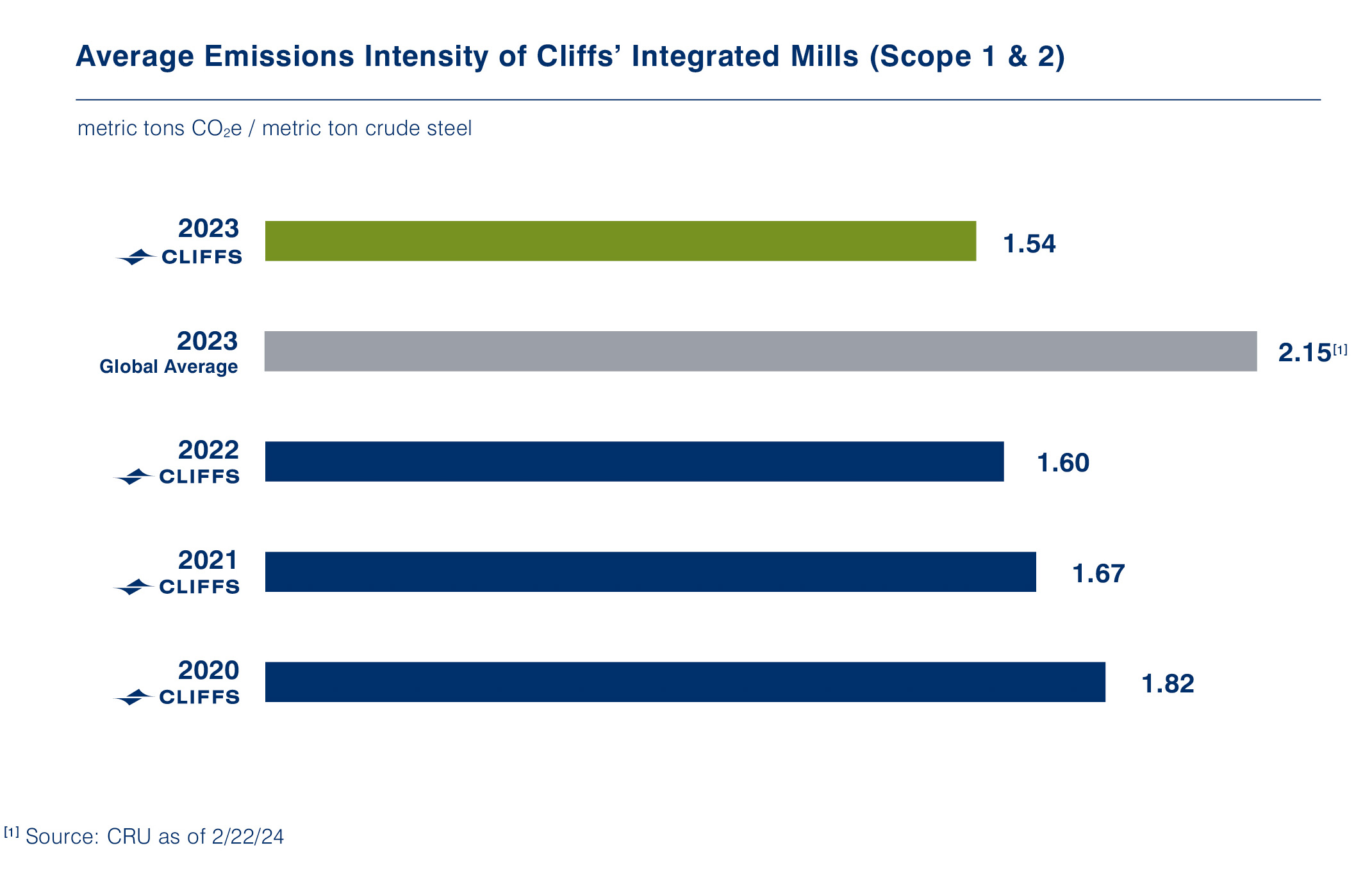

We previously reported that our 2022 GHG emissions were below our 2030 target, and as a result Cliffs was recognized as a Goal Achiever through the U.S. Department of Energy’s (“DOE”) Better Climate Challenge. We were also featured in Season Two of the Better Climate Challenge Road Show, in which our Toledo Direct Reduction (“DR”) plant was showcased. The chart below shows Cliffs’ emissions intensity continuing a favorable downward trend over the last four years.

We continue to pursue a number of decarbonization initiatives that will position us for long-term sustainability. While CLIFFS H™ is an important step toward decarbonizing the production of sophisticated grades of steel, in 2023 we saw the most consequential steps advancing towards the next phase, CLIFFS H2™, in which we plan to implement the use of hydrogen as a reductant. Hydrogen can be used in ironmaking furnaces to reduce carbon in the chemical reaction to convert iron ore into high-purity metallic iron. Cleveland-Cliffs is a leader in supporting the commercial development and deployment of clean hydrogen as a decarbonization strategy for domestic iron and steel production. Our Toledo DR plant is hydrogen-ready. In early 2024, we commissioned a pipeline and successfully completed a hydrogen injection trial at our Indiana Harbor blast furnace #7. This follows an initial similar trial of hydrogen at our blast furnace in Middletown earlier in 2023. With this initial trial, we were the first steel producer to introduce hydrogen gas as a reducing agent in a blast furnace in the Americas region.

We track and report our absolute GHG emissions in our sustainability report, as well as to government regulatory agencies and third-party sustainability ratings platforms. We disclose these metrics and additional GHG and climate-related information, such as our supplier climate engagement and upstream Scope 3 emissions, in our annual Climate Change submission to CDP, an international non-profit organization that manages the global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts. In 2023, we maintained a ‘B’ score for our Climate Change disclosure and environmental performance, which is higher than both the regional and global average scores. Additionally, we improved our Water Security disclosure and environmental performance score to a ‘B’, which is also higher than both the regional and global average scores.

9 | CLF 2024 PROXY STATEMENT

ENVIRONMENTAL, SOCIAL, GOVERNANCE AND SUSTAINABILITY

ENERGY

Cleveland-Cliffs continues to participate in the DOE’s Better Plants program and Better Climate Challenge. In March 2023, we hosted energy efficiency in-plant training at Middletown Works and our Research and Innovation Center, bringing together plant professionals, who we refer to as our “energy champions,” from across our footprint for three days of technical expert training. Since the training, our corporate sustainability team has convened the energy champions on a quarterly basis to give them the opportunity to share energy project updates with their colleagues to help cultivate a culture of energy efficiency across the Company. Building on this training and the enhanced focus on energy efficiency, numerous energy saving projects were initiated or completed during 2023 at our mines, integrated mills, specialty electric arc furnace mills and finishing facilities. These projects included boiler and steam system efficiency, LED lighting installations, and more efficient equipment, pumps, motors and fans. Collectively, these projects are anticipated to reduce the Company’s annual energy consumption of electricity and natural gas by over 70 million kilowatt hours. Additionally, we continue to make progress against our target to purchase two million megawatt hours annually of renewable power that is newly developed or additional to the existing power grid.

KEY PARTNERSHIPS

In addition to continued participation in the Better Plants program and Better Climate Challenge, we remain engaged with the DOE’s Regional Clean Hydrogen Hubs (“H2Hubs”) program. Throughout 2023, we were heavily involved in prospective hydrogen hubs as part of the DOE’s H2Hubs funding initiative. In October 2023, the DOE announced $7 billion in funding for seven H2Hubs with the goal of launching a national network of clean hydrogen producers, consumers and connective infrastructure. We have expressed interest in hydrogen offtake opportunities from at least one H2Hub: the Midwest Alliance for Clean Hydrogen (“MachH2”). MachH2 is near our two largest steel plants, Indiana Harbor and Burns Harbor, and in early 2024, we commissioned a pipeline to bring hydrogen from the fenceline of our property to Indiana Harbor blast furnace #7 (as mentioned above). MachH2 is expected to generate numerous sources of clean hydrogen production, which would benefit our iron and steelmaking operations. We have also expressed offtake interest in the Appalachian Regional Clean Hydrogen Hub (ARCH2).

HUMAN CAPITAL MANAGEMENT

Recruiting, developing and retaining top talent is critical to the success and sustainability of our Company. We are committed to building and fostering a diverse, equitable and inclusive workforce as a leading domestic steel producer. More than 90% of our hourly workforce is represented by three prominent unions: the United Steelworkers (“USW”), the United Auto Workers, and the International Association of Machinists. The hardworking union-represented men and women of Cliffs are the lifeblood of our Company, and we are proud of our collaborative partnerships with these prominent unions. We offer our employees the opportunity to continuously improve their own skill sets through a robust offering of training programs. One example is our Skilled Craft and Apprenticeship Training programs, which saw more than 730 employees complete relevant technical training and upskilling coursework. We offer above industry average total compensation opportunities to attract, motivate, reward and retain high-performing employees. Our new Rewards & Recognition program, “Thanks a Ton”, allows Cliffs employees to recognize the great work of their colleagues, with the intent to foster stronger connections and a sense of belonging in the workplace by turning everyday actions into meaningful rewards.

HEALTH AND SAFETY

Safe production is our primary Core Value as we continue to reinforce a zero injury culture at our facilities. We constantly monitor our safety performance and make continuous improvements to effect change. Best practices and incident learnings are shared throughout the Company to ensure each facility can administer the most effective policies and procedures for enhanced workplace safety. Progress toward achieving our objectives is accomplished through a focus on proactive sustainable safety initiatives, and results are measured against established industry and Company benchmarks, including our Company-wide Total Reportable Incident Rate. During 2023, our Total Reportable Incident Rate (including contractors) was 1.22 per 200,000 hours worked. This metric continued on an improved trend, and in 2023, several of our operations received industry high honors for safety performance.

COMMUNITY ENGAGEMENT

Throughout 2023, Cliffs continued to strengthen its engagement with its local host communities, and refined its charitable giving and strategic partnership priorities. In 2022, we focused on engaging with our larger operational hubs as we continued integration of our steel operations. As a more established brand in 2023, we engaged with communities around our smaller operations to foster meaningful connections and enhance long-term relationships. Cliffs’ Government and Community Relations team was active in 2023 across all aspects of community engagement, including: hosting plant tours; engaging with residents and community stakeholders; presenting to community groups; facilitating employee volunteerism and charitable giving; providing local government relations support; and working to advance Cliffs’ strategic partnerships. The team manages inquiries for the Company’s operations through our Community Inquiry Program, which continues to serve as an important tool for facilitating dialogue with stakeholders.

10 | CLF 2024 PROXY STATEMENT

ENVIRONMENTAL, SOCIAL, GOVERNANCE AND SUSTAINABILITY

CHARITABLE GIVING

Cleveland-Cliffs stayed the course relative to charitable giving by utilizing long-established avenues: The Cleveland-Cliffs Foundation (the “Foundation”), site-specific programs and events, employee volunteerism and giving, and corporate strategic partnerships. In 2023, Cleveland-Cliffs donated approximately $7.5 million to our local communities, including the Foundation matching nearly $550,000 in total employee donations.

2023 ESG HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

B score for CDP Climate Change, higher than North American and global averages | | Our integrated mill GHG emissions intensity is 28% below the global average | | ~90% Union membership (hourly workforce) |

| |

| | | | | | | |

•1.22 Total Reportable Incident Rate (including contractors) | | Cleveland-Cliffs’ Core Values are at the heart of everything we do. | |

| |

| | | | | | | |

| 100% of our steel contains recycled steel scrap | | $7.5 million donated to communities by Cleveland-Cliffs and the Foundation |

| | | | | | | | |

| | | | | | | | |

References to our sustainability reports and the contents thereof do not constitute incorporation by reference of the information contained in our sustainability reports, and such information is not part of this proxy statement.

11 | CLF 2024 PROXY STATEMENT

BOARD LEADERSHIP STRUCTURE

The Chairman of the Board is Lourenco Goncalves, who is also our President and CEO. Pursuant to our Corporate Governance Guidelines, when the positions of Board Chair and CEO are held by one individual, or if the Board Chair is a Cliffs executive, then the Governance Committee recommends to the Board a Lead Director. Douglas C. Taylor currently serves as our Lead Director. The Board believes that this leadership structure is the optimal structure to guide our Company and to maintain the focus to achieve our business goals and represents our shareholders' best interests.

Under this leadership structure, Mr. Goncalves, as Chairman, is responsible for overseeing and facilitating communications between our management and the Board, for setting the meeting schedules and agendas, and for leading discussions during Board meetings. In his combined role, Mr. Goncalves has the benefit of Cliffs personnel to help with extensive meeting preparation, responsibility for the process of recordkeeping of all Board deliberations, and the benefit of direct daily contact with management and the internal audit department. The Chairman works closely with the Lead Director in setting meeting agendas and in ensuring that essential information is communicated effectively to the Board.

The Lead Director’s responsibilities include: chairing executive session meetings of the independent directors; leading the Board’s processes for evaluating the CEO; presiding at all meetings of the Board at which the Chairman is not present; serving as a liaison between the Chairman and the independent directors; and meeting separately at least annually with each director.

This leadership structure provides our Chairman with the readily available resources to manage the affairs of the Board while allowing our Lead Director to provide effective and timely advice and guidance. Our governance process is based on our Corporate Governance Guidelines, which are available on our website at www.clevelandcliffs.com under “Investors” then “Governance” and then “Governance Documents”.

In accordance with the corporate governance listing standards of the New York Stock Exchange (the “NYSE”), our non-management directors meet at regularly scheduled executive sessions without management present. These meetings take place at least quarterly.

BOARD’S ROLE IN RISK OVERSIGHT

The Board as a whole oversees our enterprise risk management (“ERM”) process. The Board executes its risk oversight role in a variety of ways. The full Board regularly discusses the key strategic risks facing Cliffs.

The Board delegates oversight responsibility for certain areas of risk to its committees. Generally, each committee oversees risks that are associated with the purpose of and responsibilities delegated to that committee. For example, the Audit Committee oversees risks related to accounting and financial reporting, as well as information security risks. In addition, pursuant to its charter, the Audit Committee periodically reviews our ERM process. The Compensation Committee monitors risks related to development and succession planning for the CEO and other executive officers, as well as compensation and related policies and programs for executive and non-executive officers and management. The Governance Committee handles risks with respect to Board composition, membership and structure, and corporate governance matters. The Strategy and Sustainability Committee oversees, advises on, and monitors risks and opportunities relating to our strategic planning activities and ESG matters, including sustainability goals and initiatives, climate-related risks and decarbonization opportunities. As appropriate, the respective committees’ Chairpersons provide reports to the full Board.

Management is responsible for the day-to-day management of our risks. The ERM process includes the involvement of management in the identification, assessment, mitigation and monitoring of a wide array of potential risks, from strategic to operational to compliance-related risks throughout the Company. Executive management regularly reports to the Board or relevant committees regarding Cliffs’ key risks and the actions being taken to manage these risks. For example, as described more fully in Item 1C. of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, management, including the Chief Information Officer with support from our cybersecurity team, updates the Audit Committee at least twice each year regarding our cybersecurity programs, material cybersecurity risks and mitigation strategies, and the Audit Committee then regularly reports on such matters to the full Board.

The Company believes that its leadership structure supports the risk oversight function of the Board. Each committee is involved in carrying out the Board’s risk oversight function and, except for the Strategy and Sustainability Committee, independent directors chair each of our committees.

12 | CLF 2024 PROXY STATEMENT

BOARD MEETINGS AND COMMITTEES

Our directors discharge their responsibilities in a variety of ways, including reviewing reports to directors, visiting our facilities, corresponding with the CEO, and conducting telephone conferences with the CEO and other directors regarding matters of interest and concern to Cliffs. In addition, our directors have regular access to our senior management. All committees regularly report their activities, actions and recommendations to the full Board.

During 2023, our Board held 15 meetings. Each director attended, either in person or by telephone conference, at least 95% of the Board and committee meetings held while serving as a director or committee member in 2023. Pursuant to Board policy, all serving directors are expected to attend all Board and committee meetings, as well as our Annual Meeting of Shareholders. All of our then-serving directors who were standing for re-election attended the 2023 Annual Meeting of Shareholders.

The Board currently has four standing committees: the Audit Committee (the “Audit Committee”), the Compensation and Organization Committee (the “Compensation Committee”), the Governance and Nominating Committee (the “Governance Committee”), and the Strategy and Sustainability Committee (the “Strategy and Sustainability Committee”). Each of these four committees has a charter that can be found on our website at www.clevelandcliffs.com under “Investors” then “Governance”. A biographical overview of the members of our committees can be found beginning on page 22. BOARD COMMITTEES AS OF MARCH 18, 2024

| | | | | | | | |

| AUDIT COMMITTEE |

| |

MEMBERS: 4 | INDEPENDENT: 4 | 2023 MEETINGS: 9 |

AUDIT COMMITTEE FINANCIAL EXPERTS: The Board has determined that each of John T. Baldwin, Robert P. Fisher, Jr., William K. Gerber and Arlene M. Yocum is an “audit committee financial expert” within the meaning of Item 407 of Regulation S-K under the federal securities laws. |

| RESPONSIBILITIES: |

▪Reviews with our management, the internal auditors and the independent registered public accounting firm, the adequacy and effectiveness of our system of internal control over financial reporting; ▪Reviews significant accounting matters; ▪Reviews quarterly unaudited financial information prior to public release; ▪Approves the audited financial statements prior to public distribution; ▪Oversees and monitors risks related to accounting, financial reporting and information security; ▪Approves our assertions related to internal controls prior to public distribution; ▪Reviews any significant changes in our accounting principles or financial reporting practices; ▪Evaluates our independent registered public accounting firm; discusses with the independent registered public accounting firm its independence; and considers the compatibility of non-audit services with such independence; ▪Annually selects and retains our independent registered public accounting firm to examine our financial statements; and reviews and approves the services performed by our independent registered public accounting firm; ▪Establishes and maintains, with the Governance Committee, procedures to review related party transactions; ▪Approves management’s appointment, termination or replacement of the head of Internal Audit; and ▪Periodically evaluates ethical and legal compliance. |

CHAIR: John T. Baldwin | MEMBERS: Robert P. Fisher, Jr., William K. Gerber and Arlene M. Yocum |

13 | CLF 2024 PROXY STATEMENT

| | | | | | | | |

| COMPENSATION AND ORGANIZATION COMMITTEE |

| |

| MEMBERS: 3 | INDEPENDENT: 3 | 2023 MEETINGS: 7 |

| RESPONSIBILITIES: |

▪Oversees development and implementation of Cliffs’ compensation policies and programs for officers; ▪Develops criteria for awards under incentive plans that appropriately relate to Cliffs’ business strategy and operating performance objectives, and approves equity-based awards; ▪Reviews and evaluates CEO and other executive officer performance and approves compensation (with the CEO’s compensation being subject to ratification by the independent members of the Board); ▪Recommends to the Board the election of officers; ▪Assists with management development and succession planning; ▪Reviews and approves employment and severance arrangements with officers and oversees regulatory compliance regarding compensation matters and related party transactions; ▪Reviews and recommends the CD&A and the Compensation Committee report for inclusion in appropriate Cliffs securities filings; ▪Obtains the advice of outside experts with regard to compensation matters; and ▪May, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee and may delegate certain equity award grant authority to certain officers of Cliffs, subject to applicable law. For more information about the role of executives and outside advisers in our executive compensation process, see the CD&A section of this proxy statement. |

CHAIR: Douglas C. Taylor | MEMBERS: John T. Baldwin and Ralph S. Michael, III |

| | | | | | | | |

| GOVERNANCE AND NOMINATING COMMITTEE |

| |

| MEMBERS: 5 | INDEPENDENT: 5 | 2023 MEETINGS: 5 |

| RESPONSIBILITIES: |

▪Oversees annual review of our Corporate Governance Guidelines and periodically reviews external developments in corporate governance matters generally; ▪Periodically reviews and makes recommendations regarding our officers’ authorized levels for corporate expenditures; ▪Establishes and maintains, with the Audit Committee, procedures for review of related party transactions that relate to Board members; ▪Reviews the qualifications of incumbent directors and proposed Board candidates, and recommends to the Board as director-nominees those candidates possessing the experience, skills and qualifications consistent with Board-approved criteria, our Corporate Governance Guidelines and other criteria deemed important by the Governance Committee; ▪Monitors the Board governance process and provides guidance on Board governance and other matters; ▪Recommends changes in membership and responsibility of Board committees and reviews and makes recommendations regarding any conditional resignations tendered by directors; ▪Reviews and administers our director compensation plans and benefits, and makes recommendations to the Board with respect to compensation plans, equity-based plans and share ownership guidelines for directors; and ▪Other responsibilities include oversight of annual evaluation of the Board and CEO, as well as monitoring risks associated with Board organization, membership, structure and succession planning. |

CHAIR: Ralph S. Michael, III | MEMBERS: Ron A. Bloom, Robert P. Fisher, Jr., Susan M. Green and Janet L. Miller |

14 | CLF 2024 PROXY STATEMENT

| | | | | | | | |

| STRATEGY AND SUSTAINABILITY COMMITTEE |

| |

| MEMBERS: 5 | INDEPENDENT: 4 | 2023 MEETINGS: 5 |

| RESPONSIBILITIES: |

▪Oversees Cliffs’ strategic planning activities and long-term business objectives; ▪Acts in an advisory capacity with respect to Cliffs’ sustainability strategies, its commitment to environmental stewardship, its focus on health and safety of employees and other stakeholders, and its corporate social responsibility initiatives; ▪Monitors risks and opportunities relevant to Cliffs’ business strategy, including operational, safety and ESG-related risks, as well as climate-related risks and decarbonization opportunities; ▪Provides advice and assistance with developing our current and future strategy; ▪Monitors the progress and implementation of Cliffs’ strategy and long-term business objectives, including by assessing the results of major projects and transactions; ▪Assesses developments in best practice frameworks and guidance as may be appropriate in the context of Cliffs’ then current industrial assets, geographic footprint, and overall business plans and objectives; ▪Considers the merits and risks of potential acquisitions, joint ventures, emerging growth opportunities and strategic alliances; and ▪Reviews and approves any sustainability reports that Cliffs may publish from time to time. |

CHAIR: Lourenco Goncalves | MEMBERS: Ron A. Bloom, Gabriel Stoliar, Douglas C. Taylor and Arlene M. Yocum |

IDENTIFICATION AND EVALUATION OF DIRECTOR CANDIDATES

SHAREHOLDER NOMINEES

The policy of the Governance Committee is to consider properly submitted shareholder nominations for candidates for membership on the Board as described below under “Identifying and Evaluating Nominees for Director.” In evaluating nominations, the Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth below under “Board Diversity and Director Qualifications.” Any shareholder nominations proposed for consideration by the Governance Committee should include: (i) complete information as to the identity and qualifications of the proposed nominee, including name, address, present and prior business and/or professional affiliations, education and experience, and particular fields of expertise; (ii) an indication of the nominee’s consent to serve as a director if elected; and (iii) the reasons why, in the opinion of the recommending shareholder, the proposed nominee is qualified and suited to be a director. Shareholder nominations should be addressed to Cleveland-Cliffs Inc., 200 Public Square, Suite 3300, Cleveland, Ohio 44114, Attention: Secretary. Our Regulations provide that, at any meeting of shareholders at which directors are to be elected, only persons nominated as candidates will be eligible for election.

BOARD DIVERSITY AND DIRECTOR QUALIFICATIONS

The Governance Committee considers board diversity as it deems appropriate and consistent with our Corporate Governance Guidelines, the Governance Committee charter and other criteria established by the Board. The Governance Committee’s goal in selecting directors for nomination to the Board generally is to seek to create a well-balanced team that combines diverse experience, skill and intellect of seasoned directors in order to enable us to pursue our strategic objectives. The Governance Committee has not reduced the qualifications for service on the Board to a checklist of specific standards or minimum qualifications, skills or qualities. Rather, the Governance Committee seeks, consistent with the vacancies existing on the Board at any particular time and the interplay of a particular candidate’s experience with the experience of other directors, to select individuals whose business experience, knowledge, skills, diversity and integrity would be considered a desirable addition to the Board and any committees thereof. In addition, the Governance Committee annually conducts a review of incumbent directors in order to determine whether a director should be nominated for re-election to the Board.

15 | CLF 2024 PROXY STATEMENT

IDENTIFYING AND EVALUATING NOMINEES FOR DIRECTOR