UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File Number: 1-8944

CLIFFS NATURAL RESOURCES INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Ohio | | 34-1464672 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| |

200 Public Square, Cleveland, Ohio | | 44114-2315 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (216) 694-5700

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Shares, par value $0.125 per share | | New York Stock Exchange and Professional Segment of NYSE Euronext Paris |

Depositary Shares, each representing a 1/40th ownership interest in a share of 7.00% Series A Mandatory Convertible Preferred Stock, Class A | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ý NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO ý

As of June 28, 2013, the aggregate market value of the voting and non-voting common shares held by non-affiliates of the registrant, based on the closing price of $16.25 per share as reported on the New York Stock Exchange — Composite Index, was $2,577,942,533 (excluded from this figure is the voting stock beneficially owned by the registrant’s officers and directors).

The number of shares outstanding of the registrant’s common shares, par value $0.125 per share, was 153,087,255 as of February 10, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its annual meeting of shareholders scheduled to be held on May 13, 2014 are incorporated by reference into Part III.

TABLE OF CONTENTS |

| | | | | |

| | | | | |

| | | Page Number |

| | | | | |

DEFINITIONS | | | |

| | | |

PART I | | | |

| Item 1. | Business | | | |

| | Executive Officers of the Registrant | | | |

| Item 1A. | Risk Factors | | | |

| Item 1B. | Unresolved Staff Comments | | | |

| Item 2. | Properties | | | |

| Item 3. | Legal Proceedings | | | |

| Item 4. | Mine Safety Disclosures | | | |

| | | | | |

PART II | | | |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | | |

| Item 6. | Selected Financial Data | | | |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | | | |

| Item 8. | Financial Statements and Supplementary Data | | | |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | | |

| Item 9A. | Controls and Procedures | | | |

| Item 9B. | Other Information | | | |

| | | |

PART III | | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | | | |

| Item 11. | Executive Compensation | | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | | | |

| Item 14. | Principal Accountant Fees and Services | | | |

| | | | | |

PART IV | | | |

| Item 15. | Exhibits and Financial Statement Schedules | | | |

| | | |

SIGNATURES | | | |

DEFINITIONS

The following abbreviations or acronyms are used in the text. References in this report to the “Company,” “we,” “us,” “our” and “Cliffs” are to Cliffs Natural Resources Inc. and subsidiaries, collectively. References to “A$” or “AUD” refer to Australian currency, “C$” to Canadian currency and “$” to United States currency.

|

| | |

Abbreviation or acronym | | Term |

Algoma | | Essar Steel Algoma Inc. |

Amapá | | Anglo Ferrous Amapá Mineração Ltda. and Anglo Ferrous Logística Amapá Ltda. |

AG | | Autogenous Grinding |

Anglo | | Anglo American plc |

APBO | | Accumulated Postretirement Benefit Obligation |

ArcelorMittal | | ArcelorMittal (as the parent company of ArcelorMittal Mines Canada, ArcelorMittal USA and ArcelorMittal Dofasco, as well as, many other subsidiaries) |

ArcelorMittal USA | | ArcelorMittal USA LLC (including many of its North American affiliates, subsidiaries and representatives. References to ArcelorMittal USA comprise all such relationships unless a specific ArcelorMittal USA entity is referenced) |

ASC | | Accounting Standards Codification |

Barrick | | Barrick Gold Corporation Inc. |

BART | | Best Available Retrofit Technology |

Bloom Lake | | The Bloom Lake Iron Ore Mine Limited Partnership |

BNSF | | Burlington Northern Santa Fe, LLC |

Chromite Project | | Cliffs Chromite Ontario Inc. |

CIRB | | Canadian Industrial Relations Board |

CLCC | | Cliffs Logan County Coal LLC |

Clean Water Act | | Federal Water Pollution Control Act |

Cliffs Chromite Far North Inc. | | Entity previously known as Spider Resources Inc. |

Cliffs Chromite Ontario Inc. | | Entity previously known as Freewest Resources Canada Inc. |

CN | | Canadian National Railway Company |

Cockatoo Island | | Cockatoo Island Joint Venture |

Compensation Committee | | Compensation and Organization Committee |

Consent Order | | Administrative Order by Consent |

Consolidated Thompson | | Consolidated Thompson Iron Mining Limited (now known as Cliffs Quebec Iron Mining Limited) |

CQIM | | Cliffs Quebec Iron Mining Limited |

Cr2O3 | | Chromium Oxide |

CSAPR | | Cross-State Air Pollution Rule |

DD&A | | Depreciation, depletion and amortization |

DEP | | U.S. Department of Environment Protection |

Directors’ Plan | | Nonemployee Directors’ Compensation Plan, as amended and restated 12/31/2008 |

Dodd-Frank Act | | Dodd-Frank Wall Street Reform and Consumer Protection Act |

Dofasco | | ArcelorMittal Dofasco Inc. |

EBITDA | | Earnings before interest, taxes, depreciation and amortization |

Empire | | Empire Iron Mining Partnership |

EPA | | U.S. Environmental Protection Agency |

EPS | | Earnings per share |

EPSL | | Esperance Port Sea and Land |

ERM | | Enterprise Risk Management |

Exchange Act | | Securities Exchange Act of 1934, as amended |

FASB | | Financial Accounting Standards Board |

Fe | | Iron |

(Fe,Mg) (Cr,Al,Fe)2O4 | | Mineral Chromite |

FeT | | Total Iron |

FIP | | Federal Implementation Plan |

FMSH Act | | U.S. Federal Mine Safety and Health Act 1977, as amended |

Freewest | | Freewest Resources Canada Inc. (now known as Cliffs Chromite Ontario Inc.) |

GAAP | | Accounting principles generally accepted in the United States |

GHG | | Greenhouse gas |

Hibbing | | Hibbing Taconite Company |

|

| | |

Abbreviation or acronym | | Term |

ICE Plan | | Amended and Restated Cliffs 2007 Incentive Equity Plan, as amended |

INR | | INR Energy, LLC |

IRS | | U.S. Internal Revenue Service |

Ispat | | Ispat Inland Steel Company |

Koolyanobbing | | Collective term for the operating deposits at Koolyanobbing, Mount Jackson and Windarling |

LCM | | Lower of cost or market |

LIBOR | | London Interbank Offered Rate |

LIFO | | Last-in, first-out |

LTVSMC | | LTV Steel Mining Company |

MDEQ | | Michigan Department of Environmental Quality |

MMBtu | | Million British Thermal Units |

Moody's | | Moody's Investors Service, Inc., a subsidiary of Moody's Corporation, and its successors |

MPCA | | Minnesota Pollution Control Agency |

MPI | | Management Performance Incentive Plan |

MPUC | | Minnesota Public Utilities Commission |

MRRT | | Minerals Resource Rent Tax (Australia) |

MSHA | | U.S. Mine Safety and Health Administration |

n/m | | Not meaningful |

NAAQS | | National Ambient Air Quality Standards |

NBCWA | | National Bituminous Coal Wage Agreement |

NDEP | | Nevada Department of Environmental Protection |

Ni | | Nickel |

NO2 | | Nitrogen dioxide |

NOx | | Nitrogen oxide |

Northshore | | Northshore Mining Company |

NPDES | | National Pollutant Discharge Elimination System, authorized by the U.S. Clean Water Act |

NRD | | Natural Resource Damages |

NYSE | | New York Stock Exchange |

Oak Grove | | Oak Grove Resources, LLC |

OCI | | Other comprehensive income (loss) |

OPEB | | Other postretirement benefits |

OPEB cap | | Medical premium maximums |

P&P | | Proven and Probable |

PBO | | Projected benefit obligation |

Pinnacle | | Pinnacle Mining Company, LLC |

Pluton Resources | | Pluton Resources Limited |

Portman | | Portman Limited (now known as Cliffs Asia Pacific Iron Ore Holdings Pty Ltd) |

Reconciliation Act | | Health Care and Education Reconciliation Act |

Ring of Fire properties | | Black Thor, Black Label and Big Daddy chromite deposits in Ontario, Canada |

RTWG | | Rio Tinto Working Group |

S&P | | Standard & Poor's Rating Services, a division of Standard & Poor's Financial Services LLC, a subsidiary of The McGraw-Hill Companies, Inc., and its successors |

SARs | | Stock Appreciation Rights |

SEC | | U.S. Securities and Exchange Commission |

Severstal | | Severstal Dearborn, LLC |

Silver Bay Power | | Silver Bay Power Company |

SIP | | State Implementation Plan |

SMCRA | | Surface Mining Control and Reclamation Act |

SO2 | | Sulfur dioxide |

Sonoma | | Sonoma Coal Project |

Spider | | Spider Resources Inc. (now known as Cliffs Chromite Far North Inc.) |

STRIPS | | Separate Trading of Registered Interest and Principal of Securities |

| | |

| | |

|

| | |

Abbreviation or acronym | | Term |

Substitute Rating Agency | | A "nationally recognized statistical rating organization" within the meaning of Section 3 (a)(62) of the Exchange Act, selected by us (as certified by a certificate of officers confirming the decision of our Board of Directors) as a replacement agency of Moody's or S&P, or both of them, as the case may be |

Tilden | | Tilden Mining Company |

TMDL | | Total Maximum Daily Load |

TRIR | | Total Reportable Incident Rate |

TSR | | Total Shareholder Return |

U/G | | Underground |

UMWA | | United Mineworkers of America |

United Taconite | | United Taconite LLC |

UP 1994 | | 1994 Uninsured Pensioner Mortality Table |

U.S. | | United States of America |

U.S. Steel Canada | | United States Steel Corporation |

USW | | United Steelworkers |

Vale | | Companhia Vale do Rio Doce |

VEBA | | Voluntary Employee Benefit Association trusts |

VNQDC Plan | | 2005 Voluntary NonQualified Deferred Compensation Plan, as amended |

VWAP | | Volume Weighted Average Price |

Wabush | | Wabush Mines Joint Venture |

Weirton | | ArcelorMittal Weirton Inc. |

WISCO | | Wugang Canada Resources Investment Limited, a subsidiary of Wuhan Iron and Steel (Group) Corporation |

Zamin | | Zamin Ferrous Ltd |

2012 Equity Plan | | Cliffs Natural Resources Inc. 2012 Incentive Equity Plan |

PART I

Introduction

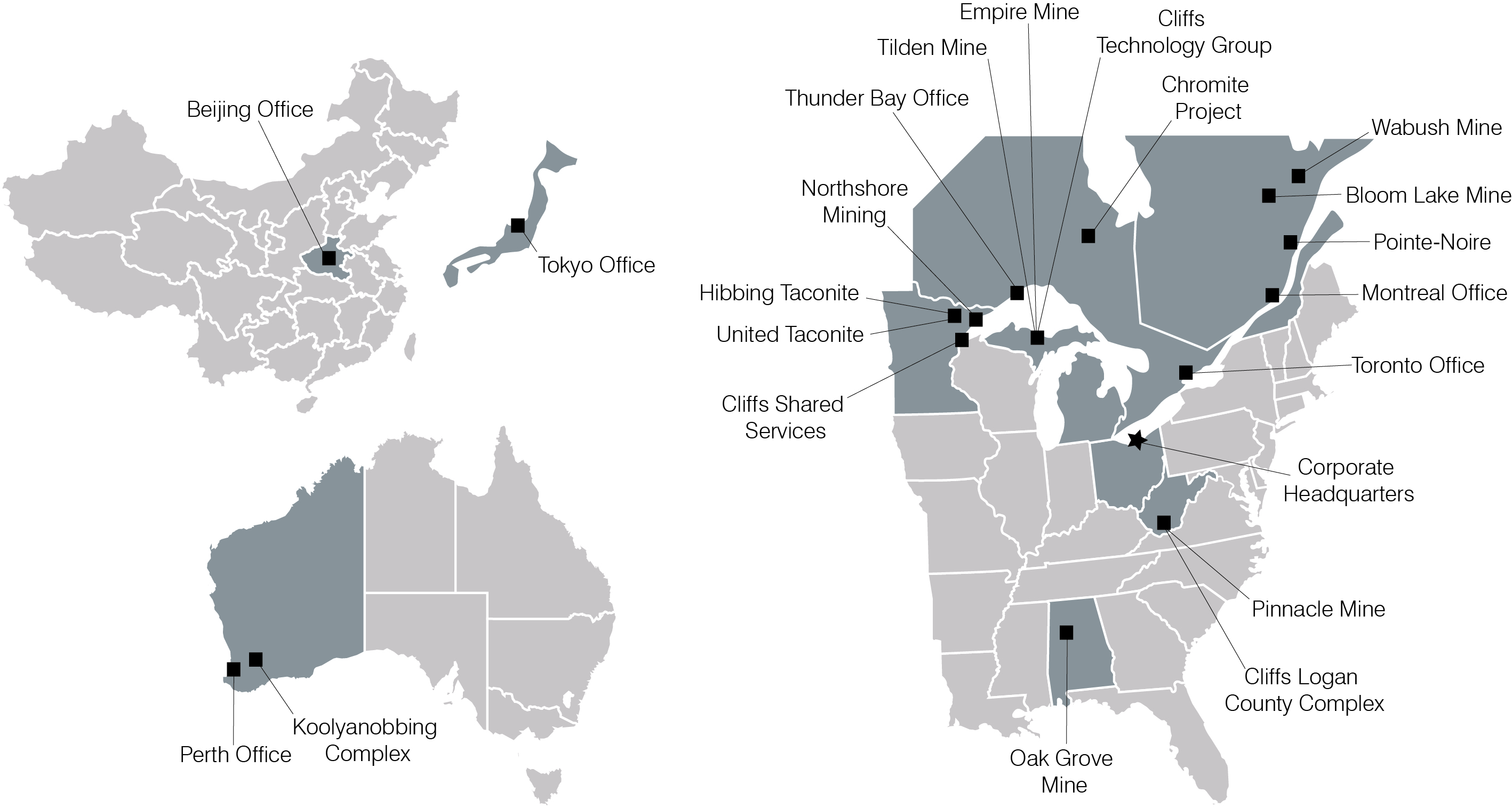

Cliffs Natural Resources Inc. traces its corporate history back to 1847. Today, we are an international mining and natural resources company. A member of the S&P 500 Index, we are a major global iron ore producer and a significant producer of high- and low-volatile metallurgical coal. Driven by the core values of safety, social, environmental and capital stewardship, our associates across the globe endeavor to provide all stakeholders with operating and financial transparency. We are organized through a global commercial group responsible for sales and delivery of our products and a global operations group responsible for the production of the minerals that we market. Our operations are organized according to product category and geographic location: U.S. Iron Ore, Eastern Canadian Iron Ore, Asia Pacific Iron Ore, North American Coal, Ferroalloys and our Global Exploration Group.

In the U.S., we currently operate five iron ore mines in Michigan and Minnesota, four metallurgical coal operations located in West Virginia and Alabama, and one thermal coal mine located in West Virginia. We also operate two iron ore mines in Eastern Canada. Our Asia Pacific operations consist solely of our Koolyanobbing iron ore mining complex in Western Australia. We also have other non-producing operations and investments around the world that provide us with optionality to diversify and expand our portfolio of assets in the future.

Industry Overview

The key driver of our business is global demand for steelmaking raw materials in both emerging and developed economies, with China and the U.S. representing the two largest markets for our Company. In 2013, China produced approximately 779 million metric tons of crude steel, or approximately 49 percent of total global crude steel production, whereas the U.S. produced approximately 87 million metric tons of crude steel, or about 5 percent of total crude steel production. These figures represent an approximate 8 percent increase and a 2 percent decrease, respectively, in crude steel production when compared to 2012.

Average global capacity utilization was about 78 percent in 2013, an approximate 2 percent increase from 2012; U.S. capacity utilization was approximately 77 percent in 2013, or about a 2 percent increase over the 2012 rate. These figures indicate that broader activity in the steel industry has increased year-over-year. Global crude steel production in 2013 grew about 4 percent compared to 2012, supported by generally improved macroeconomic fundamentals and continued, albeit tame, recovery in developed markets, including the U.S. and the Eurozone, as well as by the more rapid growth of emerging markets such as China. Broader growth in the U.S. was driven by increased personal consumption expenditures, private investment and exports, which were partly offset by decreased federal government spending and increased imports. Despite the U.S. experiencing a year-over-year decline in total crude steel production, both the automobile and oil and gas industries served as sources of healthy demand for steel in 2013. In China, investment in infrastructure remained the dominant driver of domestic steel demand and production, as its commodity-intensive growth continued.

The global price of iron ore is influenced significantly by Chinese demand and worldwide supply of iron ore. While the supply of iron ore continues to increase, the increase in 2013’s average spot market prices reflected slowing but continued economic growth expansion in China. The world market price that is utilized most commonly in our sales contracts is the Platts 62 percent Fe fines price. The Platts 62 percent Fe fines spot price increased 10.0 percent to an average price of $135 per ton for the three months ended December 31, 2013 compared to the respective quarter of 2012. In comparison, the year-to-date Platts pricing has increased 3.9 percent to an average price of $135 per metric ton during the full-year ended December 31, 2013. The spot price volatility impacts our realized revenue rates, particularly in our Eastern Canadian Iron Ore and Asia Pacific Iron Ore business segments because their contracts correlate heavily to world market spot pricing. However, the impact of this volatility on our U.S. Iron Ore revenues is muted and/or deferred partially because the pricing in our long-term contracts mostly is structured to be based on 12-month averages,

including some contracts with established annual price collars. Additionally, contracts often are priced partially or completely on other indices instead of world market spot prices.

The metallurgical coal market continues to be in an oversupplied position due to increased supply from Australian producers. Additionally, low demand by European, Japanese and South American coking coal consumers has kept pricing low. Also, there has been recent closure of coke capacity in the U.S. impacting domestic markets.

Consistent with the above, the quarterly benchmark price for premium low-volatile hard coking coal between Australian metallurgical coal suppliers and Japanese/Korean consumers decreased to a full-year average of $159 per metric ton in 2013 from $210 per metric ton in 2012. The decline in market pricing has impacted negatively realized revenue rates for our North American Coal business segment.

In 2014, we expect economic growth in the U.S. to accelerate, in part due to continued improvement in building construction, motor vehicle production, the labor market, and due to a further reduction in fiscal drag, ultimately supporting domestic steel production and thus the demand for steelmaking raw materials. We expect China’s economy will continue to expand rapidly, primarily driven by fixed asset investment while, correspondingly, increased Chinese domestic steel production will continue to require imported steelmaking raw materials to satisfy demand. However, we do expect China’s GDP growth to slow from 2013 that, when coupled with increased supply, environmental concerns and credit-tightening, could result in a weaker pricing environment for steelmaking raw materials. Nevertheless, growth in both the U.S. and China should provide a continued source of demand for our products in 2014.

Strategy

Through a number of acquisitions executed over recent years, we have increased our portfolio of assets, enhancing our production profile and project pipeline. In recent years, we have shifted from a merger and acquisition-based strategy to one that primarily focuses on organic growth and productivity initiatives. We believe our ability to gain scale and diversify our geographic footprint will increase our profitability, mitigate risk and ultimately enhance long-term shareholder value.

We believe our ability to execute our strategy is dependent on our financial position, balance sheet strength and financial flexibility to manage through the inevitable volatility in commodity prices. Throughout 2013, we took a number of deliberate steps to improve our financial position for the near and longer term. Looking ahead, we will continue to execute initiatives that improve our cost profile and increase long-term profitability. The cash generated from our operations in excess of that used for sustaining and license-to-operate capital spending and dividends will be evaluated and allocated towards initiatives that enhance shareholder value.

Recent Developments

Throughout 2013, there have been a number of changes to our Board of Directors and senior management team. Although three members of our Board of Directors departed, we welcomed four new directors in 2013. Consistent with our ongoing commitment to best practices in corporate governance, the Board separated the roles of chairman and chief executive officer and appointed an independent director as Chairman of the Board in July 2013. Our former Chairman, President and Chief Executive Officer, Joseph A. Carrabba, retired in November 2013, and the Board selected a new President and Chief Operating Officer, Gary B. Halverson. On February 13, 2014, the Board promoted Mr. Halverson to Chief Executive Officer. Prior to joining Cliffs, Mr. Halverson served as the interim chief operating officer for Barrick since September 2013 and also as its president – North America since December 2011. Previously, he served as Barrick’s president – Australia Pacific from December 2008 until December 2011 and as its director of operations – Australia Pacific from August 2006 to December 2008. James F. Kirsch assumed the role of Chairman of the Board in July 2013, and later was appointed, on an interim basis, as an executive officer with the title "Chairman", effective January 1, 2014. Also during the second half of 2013, three other executive officers left the Company. With the exception of the role filled by Mr. Halverson, these respective positions were assumed by current executive officers.

On November 20, 2013, we indefinitely suspended our Chromite Project in Northern Ontario. Given the uncertain timeline and risks associated with the development of necessary infrastructure to bring this project online, we do not expect to allocate any significant additional capital to the project. Earlier in 2013, we suspended the environmental assessment activities because of pending issues impeding the progress of the project. We will continue to work with the Government of Ontario, First Nation communities and other interested parties to explore potential solutions related to the critical infrastructure issues for the Ring of Fire properties.

On February 11, 2014, we announced that we are exploring various strategic alternatives for our Bloom Lake mine. In the short term, we will continue to operate Bloom Lake mine Phase I operations on a reduced tailings and water management capital plan. We will continue to evaluate and will idle temporarily the operations if the pricing and operating costs justify such an alternative action. As a result, the Phase II expansion project remains on hold. We additionally announced our plan to idle our Wabush mine in Newfoundland and Labrador by the end of the first quarter of 2014. The idle is being driven by the unsustainable high cost structure, which results in operations that are not economically viable to run over time.

Business Segments

Our Company’s primary operations are organized and managed according to product category and geographic location: U.S. Iron Ore, Eastern Canadian Iron Ore, Asia Pacific Iron Ore, North American Coal, Ferroalloys and our Global Exploration Group. Ferroalloys and our Global Exploration Group operating segments do not meet the criteria for reportable segments. Amapá, which was sold in the fourth quarter of 2013, previously was reported through our Latin American Iron Ore operating segment, which did not meet the criteria for a reportable segment. Additionally, Sonoma, which was sold in the fourth quarter of 2012, previously was reported through our Asia Pacific Coal operating segment, which did not meet the criteria for a reportable segment.

The U.S. Iron Ore and North American Coal business segments are headquartered in Cleveland, Ohio. The Eastern Canadian Iron Ore business segment has headquarters in Montreal, Quebec, Canada. Our Asia Pacific headquarters is located in Perth, Australia. In addition, the Ferroalloys and Global Exploration Group operating segments currently are managed from our Cleveland, Ohio location.

Segment information reflects our strategic business units, which are organized to meet customer requirements and global competition. We evaluate segment performance based on sales margin, which is defined as revenues less cost of goods sold and operating expenses identifiable to each segment. This measure of operating performance is an effective measurement as we focus on reducing production costs. Financial information about our segments, including financial information about geographic areas, is included in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and NOTE 2 - SEGMENT REPORTING included in Item 8. Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

U.S. Iron Ore

We are a major global iron ore producer, primarily selling production from U.S. Iron Ore to integrated steel companies in the U.S. and Canada. We manage and operate five iron ore mines located in Michigan and Minnesota. The U.S.-based mines currently have an annual rated capacity of 32.9 million tons of iron ore pellet production, representing 59 percent of total U.S. pellet production capacity. Based on our equity ownership in these mines, our share of the annual rated production capacity is currently 25.5 million tons, representing 46 percent of total U.S. annual pellet capacity.

The following chart summarizes the estimated annual pellet production capacity and percentage of total U.S. pellet production capacity for each of the respective iron ore producers as of December 31, 2013:

|

| | | | | | |

U.S. Iron Ore Pellet |

Annual Rated Capacity Tonnage |

| | Current Estimated Capacity (Tons in Millions)1 | | Percent of Total U.S. Capacity |

All Cliffs’ managed mines | | 32.9 |

| | 59.4 | % |

Other U.S. mines | | | | |

U.S. Steel’s Minnesota ore operations | | | | |

Minnesota Taconite | | 14.3 |

| | 25.8 |

|

Keewatin Taconite | | 5.4 |

| | 9.7 |

|

Total U.S. Steel | | 19.7 |

| | 35.5 |

|

ArcelorMittal USA Minorca mine | | 2.8 |

| | 5.1 |

|

Total other U.S. mines | | 22.5 |

| | 40.6 |

|

Total U.S. mines | | 55.4 |

| | 100.0 | % |

| | | | |

1 Tons are long tons (2,240 pounds) | | | | |

Our U.S. iron ore production generally is sold pursuant to long-term supply agreements with various price adjustment provisions. For the year ended December 31, 2013, we produced a total of 27.2 million tons of iron ore pellets, including 20.3 million tons for our account and 6.9 million tons on behalf of steel company partners of the mines.

We produce various grades of iron ore pellets, including standard and fluxed, for use in our customers’ blast furnaces as part of the steelmaking process. The variation in grades results from the specific chemical and metallurgical properties of the ores at each mine and whether or not fluxstone is added in the process. Although the grade or grades of pellets currently delivered to each customer are based on that customer’s preferences, which depend in part on the characteristics of the customer’s blast furnace operation, in many cases our iron ore pellets can be used interchangeably. Industry demand for the various grades of iron ore pellets depends on each customer’s preferences and changes from time to time. In the event that a given mine is operating at full capacity, the terms of most of our pellet supply agreements allow some flexibility in providing our customers iron ore pellets from different mines.

Standard pellets require less processing, are generally the least costly pellets to produce and are called “standard” because no ground fluxstone, such as limestone or dolomite, is added to the iron ore concentrate before turning the concentrate into pellets. In the case of fluxed pellets, fluxstone is added to the concentrate, which produces pellets that can perform at higher productivity levels in the customer’s specific blast furnace and will minimize the amount of fluxstone the customer may be required to add to the blast furnace.

Each of our U.S. Iron Ore mines is located near the Great Lakes. The majority of our iron ore pellets are transported via railroads to loading ports for shipment via vessel to steelmakers in North America or into the international seaborne market via the St. Lawrence Seaway.

Our U.S. Iron Ore sales are influenced by seasonal factors in the first quarter of the year as shipments and sales are restricted by the Army Corp of Engineers due to closure of the Soo Locks and the Welland Canal on the Great Lakes. During the first quarter, we continue to produce our products, but we cannot ship those products via lake vessel until the conditions on the Great Lakes are navigable, which causes our first quarter inventory levels to rise. Our limited practice of shipping product to ports on the lower Great Lakes or to customers’ facilities prior to the transfer of title has somewhat mitigated the seasonal effect on first quarter inventories and sales, as shipment from this point to the customers’ operations is not limited by weather-

related shipping constraints. At December 31, 2013 and 2012, we had approximately 1.2 million and 1.3 million tons of pellets, respectively, in inventory at lower lakes or customers’ facilities.

U.S. Iron Ore Customers

Our U.S. Iron Ore revenues primarily are derived from sales of iron ore pellets to the North American integrated steel industry, consisting of five major customers. Generally, we have multi-year supply agreements with our customers. Sales volume under these agreements largely is dependent on customer requirements, and in many cases, we are the sole supplier of iron ore to the customer. Historically, each agreement has contained a base price that is adjusted annually using one or more adjustment factors. Factors that could result in a price adjustment include international iron ore prices, measures of general industrial inflation and steel prices. Additionally, certain of our supply agreements have a provision that limits the amount of price increase or decrease in any given year. In 2010, the world’s largest iron ore producers moved away from the annual international benchmark pricing mechanism referenced in certain of our customer supply agreements, resulting in a shift in the industry toward shorter-term pricing arrangements linked to the spot market. These changes caused us to assess the impact a change to the historical annual pricing mechanism would have on certain of our larger existing U.S. Iron Ore customer supply agreements and resulted in modifications to certain of these agreements for the 2011 contract year. We reached final pricing settlements, which determine the calculation for our customers' prices, with all of U.S. Iron Ore customers by the end of the 2012 contract year.

During 2013, 2012 and 2011, we sold 21.3 million, 21.6 million and 24.2 million tons of iron ore pellets, respectively, from our share of the production from our U.S. Iron Ore mines. The segment’s five largest customers together accounted for a total of 85 percent, 88 percent and 83 percent of U.S. Iron Ore product revenues for the years 2013, 2012 and 2011, respectively. Refer to Concentration of Customers below for additional information regarding our major customers.

Eastern Canadian Iron Ore

Production from our two iron ore mines located in Eastern Canada primarily is sold into the seaborne market to Asian steel producers. During the second quarter of 2013, due to high production costs and lower pellet premium pricing, we idled production at our Pointe Noire iron ore pellet plant and transitioned to producing an iron ore concentrate product from our Wabush Scully Mine. As such, the Canadian-based mines currently have an annual rated capacity of 12.8 million metric tons of iron ore concentrate production.

The following chart summarizes the estimated annual concentrate production capacity and percentage of total Eastern Canadian concentrate production capacity for each of the respective iron ore producers as of December 31, 2013:

|

| | | | | | |

Eastern Canadian Iron Ore Concentrate |

Annual Rated Capacity Tonnage |

| | Current Estimated Capacity (Metric Tons in Millions) | | Percent of Total Eastern Canadian Capacity |

All Cliffs’ managed mines | | 12.8 |

| | 21.8 | % |

Other Eastern Canadian mines | | | | |

Iron Ore Company of Canada | | 18.0 |

| | 30.6 |

|

ArcelorMittal Mines Canada | | 24.0 |

| | 40.8 |

|

Other1 | | 4.0 |

| | 6.8 |

|

Total other Eastern Canadian mines | | 46.0 |

| | 78.2 |

|

Total Eastern Canadian mines | | 58.8 |

| | 100.0 | % |

| | | | |

1 Includes direct-shipped ore products | | | | |

On February 11, 2014, we announced our plan to idle our Wabush mine in Newfoundland and Labrador by the end of the first quarter of 2014, which will reduce our current estimated capacity to 7.2 million metric tons or 13.5 percent of the total Eastern Canadian capacity.

We produce a concentrate product at our Bloom Lake operation and, starting in the second half of 2013 through the idle in the first quarter of 2014, we are producing a concentrate product at our Wabush operation in Eastern Canada. The concentrate products are marketed toward steel producers, predominately based in Asia, that have sintering capabilities at their steel-making operations. The Bloom Lake concentrate is blended with other sinter fines and materials at high temperatures, creating a direct charge product used in blast furnace operations.

“High manganese” pellets, both in standard and fluxed grades, were the pellets produced through June 2013 at our Wabush operation in Eastern Canada, where there is more natural manganese in the crude ore than is found at our other operations. The manganese contained in the iron ore mined at Wabush cannot be removed entirely during the concentrating process.

Our Eastern Canadian iron ore production is sold pursuant to a mix of short-term pricing arrangements that are linked to the spot market. For the year ended December 31, 2013, we produced a total of 8.7 million metric tons of iron ore pellets and concentrate.

Both Eastern Canadian Iron Ore mines are located near the St. Lawrence Seaway. Our iron ore products are transported via railroads to loading ports for shipment via vessel to steelmakers in North America or into the international seaborne market.

Eastern Canadian Iron Ore Customers

Our Eastern Canadian Iron Ore revenues are derived from sales of iron ore concentrate and pellets to customers in Asia, Europe and North America. Due to the idled production of the Pointe Noire pellet plant in June 2013, sales will be derived from iron ore concentrate once all stockpiles of remaining pellets are sold. Sales volume under the agreements is dependent on customer requirements. We have various customers for iron ore concentrate and pellets, of which our partner in the Bloom Lake mine is considered a major customer for iron ore concentrate. ArcelorMittal is a customer of our Eastern Canadian Iron Ore operations and is an individually significant customer for Cliffs, but is not a material customer for the segment. Pricing for our Eastern Canadian Iron Ore customers consists primarily of short-term pricing arrangements that are linked to the spot market.

During 2013, 2012 and 2011, we sold 8.6 million, 8.9 million and 7.4 million metric tons of iron ore pellets and concentrate, respectively, from our Eastern Canadian Iron Ore mines, with the segment’s five largest customers together accounting for a total of 70 percent, 62 percent and 59 percent of Eastern Canadian Iron Ore product revenues, respectively. Refer to Concentration of Customers below for additional information regarding our major customers.

Asia Pacific Iron Ore

Our Asia Pacific Iron Ore operations are located in Western Australia and, as of December 31, 2013, consist solely of our wholly owned Koolyanobbing complex. Our 50 percent equity interest in Cockatoo Island also was included in these operations through September 2012, at which time we sold our interest.

The Koolyanobbing operations serve the Asian iron ore markets with direct-shipped fines and lump ore. The lump products are fed directly to blast furnaces, while the fines products are used as sinter feed. The variation in the two export product grades reflects the inherent chemical and physical characteristics of the ore bodies mined as well as the supply requirements of our customers. In September 2010, our Board of Directors approved a capital project at our Koolyanobbing operation, which was completed in the second quarter of 2012, and increased production capacity at Koolyanobbing to approximately 11.0 million metric tons annually. Production in 2013 was 11.1 million metric tons, compared with 10.7 million metric tons in 2012 and 8.2 million metric tons in 2011.

Koolyanobbing is a collective term for the operating deposits at Koolyanobbing, Mount Jackson and Windarling. There are approximately 70 miles separating the three mining areas. Banded iron formations host the mineralization, which is predominately hematite and goethite. Each deposit is characterized with different chemical and physical attributes and, in order to achieve customer product quality, ore in varying quantities from each deposit must be blended together.

Crushing and blending are undertaken at Koolyanobbing, where the crushing and screening plant is located. Once the blended ore has been crushed and screened into a direct lump and fines shipping product, it is transported by rail approximately 360 miles south to the Port of Esperance, via Kalgoorlie, for shipment to our customers in Asia.

Cockatoo Island is located off the Kimberley coast of Western Australia, approximately 1,200 miles north of Perth and is only accessible by sea and air. Cockatoo Island produced a single high-grade iron ore product known as Cockatoo Island Premium Fines, which was almost pure hematite and contained very few contaminants. Ore was mined below the sea level on the southern edge of the island, which was facilitated by a sea wall. Ore was crushed and screened on-site to the final product sizing and the premium fines product was loaded directly to the vessels berthed at the island. Our production at Cockatoo Island continued until the completion of Stage 3 mining in September 2012. Our portion of Cockatoo's annual production of iron ore premium fines totaled 0.6 million metric tons and 0.7 million metric tons in 2012 and 2011, respectively. We had no production at Cockatoo Island in 2013 due to the sale of our interest in Cockatoo Island during the third quarter of 2012, as discussed below.

On July 31, 2012, we entered into a definitive asset sale agreement with our joint venture partner, HWE Cockatoo Pty Ltd., to sell our beneficial interest in the mining tenements and certain infrastructure of Cockatoo Island to Pluton Resources, which agreement was amended on August 31, 2012. On September 7, 2012, the closing date, Pluton Resources paid a nominal sum of AUD $4.00 and assumed ownership of the assets and responsibility for the environmental rehabilitation obligations and other assumed liabilities not inherently attached to the tenements acquired. The rehabilitation obligations and assumed liabilities that inherently are attached to the tenements were transferred to Pluton Resources upon registration by the Department of Mining and Petroleum denoting Pluton Resources as the tenement holder. Upon final settlement of the sale, which was completed during the second quarter of 2013, we extinguished approximately $18.6 million related to the estimated cost of the rehabilitation. As of December 31, 2013, we have no remaining rehabilitation obligations related to Cockatoo Island.

Asia Pacific Iron Ore Customers

Asia Pacific Iron Ore’s production is under contract with steel companies primarily in China and Japan. Generally, we have three-year term supply agreements with steel producers in China and two-year supply agreements in Japan. Pricing for our Asia Pacific Iron Ore customers consists of shorter-term pricing mechanisms of various durations up to one month based on the average of daily spot prices, that are generally associated with either the time of loading or unloading each shipment. The existing contracts are due to expire at various dates until March 2015 for our Chinese and Japanese customers.

During 2013, 2012 and 2011, we sold 11.0 million, 11.7 million and 8.6 million metric tons of iron ore, respectively, from our Western Australia mines. No Asia Pacific Iron Ore customer comprised more than 10 percent of Cliffs consolidated sales in 2013, 2012 or 2011. Asia Pacific Iron Ore’s five largest customers accounted for approximately 42 percent of the segment’s sales in 2013, 44 percent in 2012 and 50 percent in 2011.

North American Coal

We own and operate four metallurgical coal operations located in West Virginia and Alabama and one thermal coal mine located in West Virginia that currently have a rated capacity of 9.4 million tons of production annually. In 2013, we sold a total of 7.3 million tons, compared with 6.5 million tons in 2012 and 4.2 million tons in 2011.

Metallurgical coal generally is sold at a premium over the more prevalently mined thermal coal, which generally is utilized to generate electricity. Metallurgical coal receives this premium because of its coking characteristics, which include contraction and expansion when heated, and volatility, which refers to the loss in mass when coal is heated in the absence of air. Coals with lower volatility are valued more highly than coals with a higher volatility.

Each of our North American coal mines are positioned near rail or barge lines providing access to international shipping ports, which allows for export of our coal production.

North American Coal Customers

North American Coal’s metallurgical coal production is sold to global integrated steel and coke producers in Europe, North America, China, India and South America and its thermal coal production is sold to energy companies and distributors in North America and Europe. Approximately 70 percent of our 2013 and 2012 production was committed under contracts of at least one year. Approximately 50 percent of our projected 2014 production has been committed and priced. North American contract negotiations are largely completed, and international contract negotiations recently have begun. The remaining tonnage primarily is pending price negotiations with our international customers, which typically is dependent on settlements of Australian pricing for metallurgical coal. International customer contracts typically are negotiated on a fiscal year basis extending from April 1 through March 31, whereas customer contracts in North America typically are negotiated on a calendar year basis extending from January 1 through December 31.

International and North American sales represented 61 percent and 39 percent, respectively, of our North American Coal sales in 2013. This compares with 66 percent and 34 percent, respectively, in 2012 and 54 percent and 46 percent, respectively, in 2011. The segment’s five largest customers together accounted for a total of 57 percent, 50 percent and 58 percent of North American Coal product revenues for the years 2013, 2012 and 2011, respectively. Refer to Concentration of Customers below for additional information regarding our major customers.

Investments

Amapá

On December 27, 2012, our Board of Directors authorized the sale of our 30 percent interest in Amapá. Per this original agreement, together with Anglo, we were to sell our respective interest in a 100 percent sale transaction to Zamin.

On March 28, 2013, an unknown event caused the Santana port shiploader to collapse into the Amazon River, preventing further ship loading by the mine operator, Anglo. In light of the March 28, 2013 collapse of the Santana port shiploader and subsequent evaluation of the effect that this event had on the carrying value of our investment in Amapá as of June 30, 2013, we recorded an impairment charge of $67.6 million in the second quarter of 2013.

On August 28, 2013, we entered into additional agreements to sell our 30 percent interest in Amapá to Anglo for nominal cash consideration, plus the right to certain contingent deferred consideration upon the two-year anniversary of the closing. The closing was conditional on obtaining certain regulatory approvals and the additional agreement provided Anglo with an option to request that we transfer our interest in Amapá directly to Zamin. Anglo exercised this option and the transfer to Zamin closed in the fourth quarter of 2013. Our interest in Amapá previously was reported as our Latin American iron ore operating segment.

Sonoma

On July 10, 2012, we entered into a definitive share and asset sale agreement to sell our 45 percent economic interest in the Sonoma joint venture coal mine located in Queensland, Australia. Upon completion of the transaction on November 12, 2012, we collected approximately AUD $141.0 million in net cash proceeds. The assets sold included our interests in the Sonoma mine along with our ownership of the affiliated wash plant, which were previously reported as our Asia Pacific Coal operating segment. Production and sales totaled approximately 2.8 million and 2.9 million metric tons of coal, respectively, through the same completion date. This compares with production and sales of approximately 3.5 million and 3.1 million metric tons in 2011, respectively.

Applied Technology, Research and Development

We have been a leader in iron ore mining and process technology for more than 160 years. We operated some of the first mines on Michigan’s Marquette Iron Range and pioneered early open-pit and underground mining methods. From the first application of electrical power in Michigan’s underground mines to the use of today’s sophisticated computers and global positioning satellite systems, we have been a leader in the application of new technology to the centuries-old business of mineral extraction. Today, our engineering and technical staffs are engaged in full-time technical support of our operations and improvement of existing products.

We continue to leverage our advanced technical expertise to develop and execute projects that concentrate and process low grade ores into high-quality products for international markets. With state-of-the-art equipment and experienced technical professionals, we remain on the forefront of mining technology. We have an unsurpassed reputation for our pelletizing technology, delivering a world-class quality product to a broad range of sophisticated end users. We are a pioneer in the development of emerging reduction technologies, a leader in the extraction of value from challenging resources and a frontrunner in the implementation of safe and sustainable technology. Our technical experts are dedicated to excellence and deliver superior technical solutions tailored to our expanding global customer base.

Exploration

We have several projects and potential opportunities to diversify our products, expand our production volumes and develop large-scale ore bodies through early involvement in exploration activities. We achieve this by partnering with junior mining companies, which provide us low-cost entry points for potentially significant reserve additions. Our global exploration group is led by professional geologists who have the knowledge and experience to identify new projects for future development or projects that add significant value to existing operations. We spent approximately $10.8 million, $73.3 million and $48.4 million on exploration activities in 2013, 2012, and 2011, respectively. In alignment with our capital allocation strategy, we anticipate significantly decreased levels of exploration spending in 2014.

Concentration of Customers

We had one customer, ArcelorMittal, that individually accounted for more than 10 percent of our consolidated product revenue in each period during 2013, 2012 and 2011. Product revenue from ArcelorMittal represented approximately $1.0 billion, $0.9 billion, and $1.4 billion of our total consolidated product revenue in 2013, 2012 and 2011, respectively, and is attributable to our U.S. Iron Ore, Eastern Canadian Iron Ore and North American Coal business segments. The following represents sales revenue from ArcelorMittal as a percentage of our total consolidated product revenue, as well as the portion of product sales for U.S. Iron Ore, Eastern Canadian Iron Ore and North American Coal that is attributable to ArcelorMittal in 2013, 2012 and 2011, respectively:

|

| | | | | | | | | | |

| | | Percentage of Total Product Revenue1 |

Customer2 | | 2013 | | 2012 | | 2011 |

ArcelorMittal | | 19 | % | | 17 | % | | 21 | % |

| | | | | | | |

1 Excluding freight and venture partners’ cost reimbursements. |

2 Includes subsidiaries. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Percentage of U.S. Iron Ore Product Revenue1 | | Percentage of Eastern Canadian Iron Ore Product Revenue1 | | Percentage of North American Coal Product Revenue1 |

Customer2 | | 2013 | | 2012 | | 2011 | | 2013 | | 2012 | | 2011 | | 2013 | | 2012 | | 2011 |

ArcelorMittal | | 36 | % | | 32 | % | | 38 | % | | 10 | % | | 9 | % | | 10 | % | | 7 | % | | 5 | % | | 7 | % |

| | | | | | | | | | | | | | | | | | | |

1 Excluding freight and venture partners’ cost reimbursements. | | | | | | |

2 Includes subsidiaries. | | | | | | |

On April 8, 2011, we entered into an Omnibus Agreement with ArcelorMittal USA in order to settle pending arbitrations. The Omnibus Agreement, among other things, amends the Pellet Sale and Purchase Agreement dated December 31, 2002 (the “Supply Agreement”) covering the Indiana Harbor East facility. Under the terms of the settlement, the parties established specific pricing levels for 2009 and 2010 pellet sales and revised the pricing calculation for the remainder of the term of the Supply Agreement. It was also agreed that a world market-based pricing mechanism would be used beginning in 2011 and through the remainder of the contract term covering the Supply Agreement. As a result of this new pricing, both parties agreed to forego future price re-openers.

Our pellet supply agreements with ArcelorMittal USA are the basis for supplying pellets to ArcelorMittal USA, which is based on customer requirements, except for the Indiana Harbor East facility, which is based on customer excess requirements. As discussed above, the Omnibus Agreement amended the Supply Agreement covering the Indiana Harbor East facility in April 2011. The following table outlines the expiration dates for each of the respective agreements:

|

| |

Facility | Agreement Expiration |

Cleveland Works and Indiana Harbor West facilities | 2016 |

Indiana Harbor East facility | 2015 |

We also have an agreement with ArcelorMittal's Weirton facility, expiring in 2018; however, it is a non-operational facility.

ArcelorMittal USA is a 62.3 percent equity participant in Hibbing and a 21.0 percent equity partner in Empire with limited rights and obligations.

In 2013, 2012 and 2011, our U.S. Iron Ore pellet sales to ArcelorMittal were 9.5 million, 8.6 million and 8.7 million tons, respectively, and our Eastern Canadian Iron Ore pellet and concentrate sales to ArcelorMittal were 0.9 million, 0.7 million and 0.7 million metric tons, respectively.

Our current North American Coal supply agreements with ArcelorMittal run through December 31, 2014 and are based on an annual tonnage commitment for the 12-month fiscal period. Contracts are renewed annually and priced on a quarterly basis, with pricing generally in line with Australian pricing for metallurgical coal. In 2013, 2012 and 2011, our North American Coal sales to ArcelorMittal were 0.5 million, 0.3 million and 0.2 million tons, respectively.

Competition

Throughout the world, we compete with major and junior mining companies, as well as metals companies, both of which produce steelmaking raw materials, including iron ore and metallurgical coal.

North America

In our U.S. Iron Ore business segment, we primarily sell our product to steel producers with operations in North America. In our Eastern Canadian Iron Ore business segment, we primarily provide our product to the seaborne market for Asian steel producers. We compete directly with steel companies that own interests in iron ore mines, including ArcelorMittal and U.S. Steel, and with major iron ore exporters from Australia and Brazil.

In the coal industry, our North American Coal business segment competes with many metallurgical coal producers of various sizes, including Alpha Natural Resources, Inc., Patriot Coal Corporation, CONSOL Energy Inc., Arch Coal, Inc., Walter Energy, Inc., Peabody Energy Corp. and other producers located in North America and globally.

A number of factors beyond our control affect the markets in which we sell our iron ore and coal. Continued demand for our iron ore and metallurgical coal and the prices obtained by us primarily depend on the consumption patterns of the steel industry in China, the U.S. and elsewhere around the world, as well as the availability, location, cost of transportation and competing prices. Coal consumption patterns primarily are affected by demand, environmental and other governmental regulations and technological developments. The most important factors on which we compete are delivered price, coal quality characteristics such as heat value, sulfur, ash, volatile matter and moisture content and reliability of supply. Metallurgical coal, which primarily is used to make coke, a key component in the steelmaking process, generally sells at a premium over thermal coal due to its higher quality and value in the steelmaking process.

Asia Pacific

In our Asia Pacific Iron Ore business segment, we export iron ore products to the Asia Pacific markets, including China, Japan and Taiwan. In the Asia Pacific marketplace, we compete with major iron ore exporters from Australia, Brazil, South Africa and India. These include Anglo, BHP Billiton, Fortescue Metals Group Ltd., Rio Tinto plc and Vale, among others.

Competition in steelmaking raw materials is predicated upon the usual competitive factors of price, availability of supply, product quality and performance, service and transportation cost to the consumer of the raw materials.

Environment

Our mining and exploration activities are subject to various laws and regulations governing the protection of the environment. We conduct our operations in a manner that is protective of public health and the environment and believe our operations are in compliance with applicable laws and regulations in all material respects.

Environmental issues and their management continued to be an important focus at each of our operations throughout 2013. In the construction of our facilities and in their operation, substantial costs have

been incurred and will continue to be incurred to avoid undue effect on the environment. Our capital expenditures relating to environmental matters totaled approximately $32 million, $31 million and $36 million, in 2013, 2012 and 2011, respectively. It is estimated that capital expenditures for environmental improvements will total approximately $42 million in 2014. Estimated expenditures in 2014 are comprised of approximately $25 million for projects at our Eastern Canadian Iron Ore operations, $13 million for projects in our U.S. Iron Ore operations and $4 million in our North American Coal operations for various water treatment, air quality, (dust) control, selenium management, tailings management and other miscellaneous environmental projects.

Regulatory Developments

Various governmental bodies continually are promulgating new or amended laws and regulations that affect our Company, our customers and our suppliers in many areas, including waste discharge and disposal, the classification of materials and products, air and water discharges and many other environmental, health and safety matters. Although we believe that our environmental policies and practices are sound and do not expect that the application of any current laws or regulations reasonably would be expected to result in a material adverse effect on our business or financial condition, we cannot predict the collective adverse impact of the expanding body of laws and regulations.

Specifically, there are several notable proposed or potential rulemakings or activities that could potentially have a material adverse impact on our facilities in the future depending on their ultimate outcome: Climate Change and GHG Regulation, Regional Haze, NO2 and SO2 National Ambient Air Quality Standards, Cross State Air Pollution Rule, increased administrative and legislative initiatives related to coal mining activities, Mercury TMDL and Minnesota Taconite Mercury Reduction Strategy, and Selenium Discharge Regulation.

Climate Change and GHG Regulation

With the complexities and uncertainties associated with the U.S. and global navigation of the climate change issue as a whole, one of our significant risks for the future is mandatory carbon legislation. Policymakers are in the design process of carbon regulation at the state, regional, national and international levels. The current regulatory patchwork of carbon compliance schemes presents a challenge for multi-facility entities to identify their near-term risks. Amplifying the uncertainty, the dynamic forward outlook for carbon regulation presents a challenge to large industrial companies to assess the long-term net impacts of carbon compliance costs on their operations. Our exposure on this issue includes both the direct and indirect financial risks associated with the regulation of GHG emissions, as well as potential physical risks associated with climate change. We are continuing to review the physical risks related to climate change utilizing a formal risk management process.

Internationally, mechanisms to reduce emissions are being implemented in various countries, with differing designs and stringency, according to resources, economic structure and politics. We expect that momentum to extend carbon regulation following the expiration in 2012 of the first commitment period under the Kyoto Protocol will continue. Australia and Canada are signatories to the Kyoto Protocol. As such, our facilities in each of these countries are impacted by the Kyoto Protocol, but in varying degrees according to the mechanisms each country establishes for compliance and each country’s commitment to reducing emissions. Australia and Canada are considered Annex 1 countries, meaning that they are obligated to reduce their emissions under the Protocol. The impact of the Kyoto Protocol on our Canadian operations recently has been brought into question by the December 2011 announcement by the Canadian Environment Minister that Canada would withdraw from the Kyoto Protocol and, furthermore, that Canada would repeal its Kyoto Protocol Implementation Act.

In Australia, legislation for a carbon tax took effect in July 2012. The direct impact of the carbon tax on our Asia Pacific operations primarily occurs through increased fuel costs. The tax is estimated to result in an increase in direct costs of approximately A$3.5 million per year. However, recent developments are likely to lead to changes to the carbon legislation. In September 2013, a new government was elected and announced its intention to repeal the carbon legislation. Hence it remains uncertain whether repeal legislation will be passed.

On December 15, 2011, Quebec issued final GHG cap-and-trade regulation based on the Western Climate Initiative guidelines that became effective January 1, 2013. Phase 1 of the Quebec GHG emission reduction objective is to reduce GHG emissions by 20 percent below 1990 levels by 2020. The mining and utility sectors, among others, are sectors included in the cap-and-trade program. The Quebec framework has provisions for “free” allocations for our sector, which will minimize the impact to our business. According to Phase 1 of the GHG cap-and-trade program, the estimated direct impact to our Eastern Canadian Iron Ore operations begins at $1 million per year in 2015 and escalates to an estimated $3 million per year in 2020. Additional indirect “pass-through” financial impacts related to energy rates and transportation fuel consumption are estimated to increase our exposure; however, the overall impact is not anticipated to have a material impact on our business.

In the U.S., federal carbon regulation potentially presents a significantly greater impact to our operations. To date, the U.S. has not legislated carbon constraints. In the absence of comprehensive federal carbon legislation, numerous state and regional regulatory initiatives are under development or are becoming effective, thereby creating a disjointed approach to carbon control. On June 25, 2013, President Obama issued a memorandum directing the EPA to develop carbon emission standards for both new and existing power plants under the Clean Air Act's New Source Performance Standards (NSPS). On January 8, 2014, the EPA proposed NSPS regulating carbon dioxide emissions from new fossil fuel-fired power plants and the EPA is expected to propose standards for modified power plants and for existing plants under the Clean Air Act by June 1, 2014 in separate actions.

As an energy-intensive business, our GHG emissions inventory captures a broad range of emissions sources, such as iron ore furnaces and kilns, coal thermal driers, diesel mining equipment and a wholly owned power generation plant, among others. As such, our most significant regulatory risks are: (1) the costs associated with on-site emissions levels, and (2) the costs passed through to us from power generators and distillate fuel suppliers.

We believe our exposure can be reduced substantially by numerous factors, including currently contemplated regulatory flexibility mechanisms, such as allowance allocations, fixed process emissions exemptions, offsets and international provisions; emissions reduction opportunities, including energy efficiency, biofuels, fuel flexibility, emerging shale gas, and coal mine methane offset reduction; and business opportunities associated with new products and technology.

We have worked proactively to develop a comprehensive, enterprise-wide GHG management strategy aimed at considering all significant aspects associated with GHG initiatives to plan effectively for and manage climate change issues, including risks and opportunities as they relate to the environment, stakeholders, including shareholders and the public, legislative and regulatory developments, operations, products and markets.

Regional Haze

In June 2005, the EPA finalized amendments to its regional haze rules. The rules require states establish goals and emission reduction strategies for improving visibility in all Class I national parks and wilderness areas. Among the states with Class I areas are Michigan, Minnesota, Alabama and West Virginia in which we currently own and manage mining operations. The first phase of the regional haze rule (2008-2018) requires analysis and installation of BART on eligible emission sources and incorporation of BART and associated emission limits into SIPs.

Minnesota submitted a regional haze SIP to the EPA on December 30, 2009, and a supplement to the SIP on May 8, 2012. Michigan submitted its regional haze SIP to the EPA on November 5, 2010. During the second quarter of 2012, the EPA also sent information requests to all taconite facilities requesting information on SO2 and NOx emissions and control technology assessments. On June 12, 2012, the EPA approved revisions to the Minnesota SIP addressing regional haze, but also announced it was deferring action on emission limitations that Minnesota intended to represent BART for taconite facilities. On August 15, 2012, the EPA proposed to deny the Michigan and Minnesota taconite SIP BART determinations and simultaneously proposed a separate FIP for taconite facilities. During the comment period for the proposed FIP rule, the

taconite industry and other stakeholders developed detailed comments and shared information to address furnace specific case-by-case circumstances. On January 15, 2013, the EPA signed the final FIP for taconite facilities. The final FIP reflects progress toward a more technically and economically feasible regional haze implementation plan and eliminates the need for investing in additional SO2 emission control equipment. However, we remain concerned about the technical and economic feasibility of EPA's BART determination for NOx emissions and are conducting detailed engineering analysis to determine the impact of the regulations on each unique iron ore indurating furnace affected by this rule. The results of this analysis will guide further dialogue with the EPA regarding our implementation of the regional haze FIP requirements.

NO2 and SO2 National Ambient Air Quality Standards

During the first half of 2010, the EPA promulgated rules that require states to use a combination of air quality monitoring and computer modeling to determine areas of each state that are in attainment with new NO2 and SO2 standards (attainment areas) and those areas that are not in attainment with such standards (nonattainment areas). During the third quarter of 2011, the EPA issued guidance to the regulated community on conducting refined air quality dispersion modeling and implementing the new NO2 and SO2 standards. The NO2 and SO2 standards have been challenged by various large industry groups. Accordingly, at this time, we are unable to predict the final impact of these standards. During June 2011, our Minnesota iron ore mining operations received a request from the MPCA to develop modeling and compliance plans and timelines by which each facility would demonstrate compliance with present and proposed NAAQS as well as regional haze requirements outlined in the SIP. Compliance must be achieved by June 30, 2017 according to the initial state orders, although the EPA has indicated that the SO2 attainment designation timelines have been extended out to 2020. We continue to assess options by which to achieve compliance and seek alignment between the state and federal expectations.

Cross State Air Pollution Rule

On July 6, 2011, the EPA promulgated the CSAPR, which was intended to be an emissions trading rule for SO2 and NOx. Northshore's Silver Bay Power Plant would have been subject to this rule, however Minnesota elected to follow EPA guidance allowing CSAPR to stand as BART. CSAPR was vacated by the D.C. Circuit Court during the third quarter of 2012. Although the CSAPR requirements were vacated, this would likely result in Silver Bay Power Plant Unit 2 again being subject to a site-specific BART determination under the regional haze rule that, in 2008, included application of control equipment to reduce SO2 and NOx. Minnesota has yet to re-evaluate BART determinations for Minnesota facilities that would have been subject to CSAPR, but emission reductions of some form are likely. We presently are re-evaluating compliance options in light of this rule change.

Increased Administrative and Legislative Initiatives Related to Coal Mining Activities

Although the focus of significantly increased government activity related to coal mining in the U.S. is generally targeted at eliminating or minimizing the adverse environmental impacts of mountaintop coal mining practices, these initiatives have the potential to impact all types of coal operations, including subsurface longwall mining typically deployed for recovering metallurgical coal. Specifically, the coordinated efforts by various federal agencies to further regulate mountaintop mining have slowed issuance of the permits required by many mining projects in Appalachia. Due to the developing nature of these initiatives and their potential to disrupt even routine mining and water permit practices in the coal industry, we are unable to predict whether these initiatives could have a material effect on our coal operations in the future. We are working closely with our trade associations to monitor the various rulemaking developments in an effort to enable us to develop viable strategies to minimize the financial impact to the business.

Mercury TMDL and Minnesota Taconite Mercury Reduction Strategy

TMDL regulations are contained in the Clean Water Act. As a part of Minnesota's Mercury TMDL Implementation Plan, in cooperation with the MPCA, the taconite industry developed a Taconite Mercury Reduction Strategy and signed a voluntary agreement to effectuate its terms. The strategy includes a 75 percent target reduction of mercury air emissions from Minnesota pellet plants collectively by 2025. It recognizes that mercury emission control technology currently does not exist and will be pursued through a research effort. Any developed technology must be economically feasible, must not impact pellet quality, and must not cause excessive corrosion in pellet furnaces, associated duct work and existing wet scrubbers on the furnaces.

According to the voluntary agreement, the mines proceeded with medium- and long-term testing of possible technologies. Initial testing will be completed on one straight-grate and one grate-kiln furnace among the mines. If technically and economically feasible, developed mercury emission control technology must then be installed on taconite furnaces by 2025. For Cliffs, the requirements in the voluntary agreement will apply to the United Taconite and Hibbing facilities. At this time, we are unable to predict the potential impacts of the Taconite Mercury Reduction Strategy. However, a number of research projects were conducted between 2011 and 2013 as the industry continues to assess options for reduction. While injection of powdered activated carbon into furnace off-gasses for mercury capture in the wet scrubbers showed positive initial results, further testing during 2013 yielded lower overall potential. Alternate technologies are presently being assessed for potential further pilot testing.

Late in 2013, Minnesota also published a draft mercury control rule for the state that would require annual mercury emissions reporting and could require installation of mercury emission control equipment on all Cliffs’ Minnesota facilities. Installation of emission control equipment may be required on Northshore’s Silver Bay Power Plant by January 1, 2018 to achieve a 70% reduction of mercury emissions. The rule as proposed would formalize elements of the aforementioned voluntary agreement.

Selenium Discharge Regulation

Our North American Coal operations have numerous NPDES permits with either selenium discharge limits, selenium compliance schedules with effective dates in the future, or draft permits with selenium limits. We have achieved, or have projects underway that will achieve compliance at all discharges. As such, we do not believe this issue will likely have a material impact to our North American Coal operations.

In Michigan, the MDEQ issued renewed NPDES permits for our Empire mine in December 2011 and for our Tilden mine in 2012. Our Michigan operations at Empire and Tilden are developing compliance strategies to meet new selenium process water limits according to the permit conditions. Empire and Tilden submitted the Selenium Storm Water Management Plan to the MDEQ in December 2011. The Selenium Storm Water Management Plan outlines the activities that will be undertaken to address selenium in storm water discharges from our Michigan operations. The activities include the evaluation of structural controls, non-structural controls, site specific standards, and evaluation of potential impacts to groundwater. Preliminary selenium treatability results from studies in 2013 were positive for the utilization of passive treatment systems. A pilot treatment system was installed during the third quarter of 2012 with good initial results, but evaluation work continues with the installation of an additional system in 2013. An initial estimate for full scale implementation of storm water treatment systems and structural selenium controls at both facilities is approximately $63 million. The results from the evaluation of existing pilot and demonstration scale work will determine if these structural controls are utilized, or if alternatives must be applied.

Tilden's NPDES permit renewal became effective on November 1, 2012. The permit contains a compliance schedule for selenium with a limit of five µg/l that will be effective as of November 1, 2017 at Tilden's Gribben Tailings Basin outfall. Preliminary engineering for end-of-pipe solutions indicates capital costs could range from $96 million to $146 million with annual operating and maintenance costs ranging from $2 million to $30 million. Tilden has initiated a prudent and feasible alternatives analysis to further define solutions and cost estimates with the requirement of completing pilot testing by May 1, 2015.

Other Developments

Clean Water Act Section 404

In the U.S., Section 404 of the Clean Water Act requires permits from the U.S. Army Corps of Engineers to construct mines and associated projects, such as freshwater impoundments, tailings impoundments and refuse disposal fills, in areas that affect jurisdictional waters. Any coal mining activity requiring both a Section 404 permit and a SMCRA permit in the Appalachian region currently undergoes an enhanced review from the U.S. Army Corps of Engineers, the EPA and the Office of Surface Mining. With the acquisition of the CLCC properties during the third quarter of 2010, we obtained a development surface coal mine project, the Toney Fork No. 3, which is subject to the enhanced review process adopted by federal agencies in 2009 for Section 404 permitting. There currently are two proposed valley fills in the Toney Fork No. 3 plan; therefore, an extensive review process can be expected. We expect on-going negotiations with the EPA will conclude with the issuance of the required Section 404 permit well before construction of the mine is scheduled. The other development surface mine project acquired through the acquisition of CLCC, Toney Fork West, does not require Section 404 permitting. The renewal date for the existing Toney Fork No. 2 permit is May 28, 2015.

For additional information on our environmental matters, refer to Item 3. Legal Proceedings and NOTE 12 - ENVIRONMENTAL AND MINE CLOSURE OBLIGATIONS in Item 8. Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

Energy

Electricity

The state of Michigan is a deregulated electricity state, which affords our mines the ability to purchase electrical energy supply from various suppliers while continuing to purchase distribution service from the incumbent utility. As of September 1, 2013, our Tilden and Empire mines in Michigan exercised the right to purchase electrical supply from Integrys Energy Services while continuing to purchase distribution service from Wisconsin Electric Power Company. The pricing of electricity in the deregulated market is based on the Midwestern Independent System Operator Day-Ahead price.

Electric power for the Hibbing and United Taconite mines is supplied by Minnesota Power. On September 16, 2008, the mines finalized agreements with terms from November 1, 2008 through December 31, 2015. The agreements were approved by the MPUC in 2009.

Silver Bay Power Company, a wholly owned subsidiary of ours, with a 115 megawatt power plant, provides the majority of Northshore’s electrical energy requirements. Silver Bay Power has an interconnection agreement with Minnesota Power for backup power when excess generation is necessary.

Wabush has a 20-year agreement with Newfoundland Power, which continues until December 31, 2014. This agreement allows for an exchange of water rights in return for the power needs for Wabush’s mining operations. The Wabush pelletizing operation and the Bloom Lake operation in Quebec are served by Quebec Hydro, which provides power under non-negotiated rates that are set on an annual basis.

The Oak Grove mine and Concord Preparation Plant are supplied electrical power by Alabama Power under a five-year contract that continues in effect until terminated by either party providing written notice to the other in accordance with applicable rules, regulations and rate schedules. Rates of the contract are subject to change during the term of the contract as regulated by the Alabama Public Services Commission.

Electrical power to the Pinnacle Complex and CLCC is supplied by the Appalachian Power Company under two regulated electrical supply contracts. Both contracts specify the applicable rate schedule, minimum monthly charge and power capacity furnished. Rates, terms and conditions of the contracts are subject to the approval of the Public Service Commission of West Virginia.

Koolyanobbing and its associated satellite mines draw power from independent diesel-fueled power stations and generators. Diesel power generation capacity has been installed at the Koolyanobbing operations.

Process Fuel