000076406512/312024Q3falsexbrli:sharesiso4217:USDiso4217:USDxbrli:sharesclf:Employeeiso4217:CADxbrli:sharesclf:segmentxbrli:pureclf:MMBtuutr:MWh00007640652024-01-012024-09-3000007640652024-11-0500007640652024-09-3000007640652023-12-3100007640652024-07-012024-09-3000007640652023-07-012023-09-3000007640652023-01-012023-09-3000007640652022-12-3100007640652023-09-300000764065us-gaap:CommonStockMember2023-12-310000764065us-gaap:AdditionalPaidInCapitalMember2023-12-310000764065us-gaap:RetainedEarningsMember2023-12-310000764065us-gaap:TreasuryStockCommonMember2023-12-310000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000764065us-gaap:NoncontrollingInterestMember2023-12-310000764065us-gaap:RetainedEarningsMember2024-01-012024-03-310000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000764065us-gaap:NoncontrollingInterestMember2024-01-012024-03-3100007640652024-01-012024-03-310000764065us-gaap:CommonStockMember2024-01-012024-03-310000764065us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000764065us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000764065us-gaap:CommonStockMember2024-03-310000764065us-gaap:AdditionalPaidInCapitalMember2024-03-310000764065us-gaap:RetainedEarningsMember2024-03-310000764065us-gaap:TreasuryStockCommonMember2024-03-310000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000764065us-gaap:NoncontrollingInterestMember2024-03-3100007640652024-03-310000764065us-gaap:RetainedEarningsMember2024-04-012024-06-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000764065us-gaap:NoncontrollingInterestMember2024-04-012024-06-3000007640652024-04-012024-06-300000764065us-gaap:CommonStockMember2024-04-012024-06-300000764065us-gaap:TreasuryStockCommonMember2024-04-012024-06-300000764065us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000764065us-gaap:CommonStockMember2024-06-300000764065us-gaap:AdditionalPaidInCapitalMember2024-06-300000764065us-gaap:RetainedEarningsMember2024-06-300000764065us-gaap:TreasuryStockCommonMember2024-06-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000764065us-gaap:NoncontrollingInterestMember2024-06-3000007640652024-06-300000764065us-gaap:RetainedEarningsMember2024-07-012024-09-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000764065us-gaap:NoncontrollingInterestMember2024-07-012024-09-300000764065us-gaap:CommonStockMember2024-07-012024-09-300000764065us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000764065us-gaap:TreasuryStockCommonMember2024-07-012024-09-300000764065us-gaap:CommonStockMember2024-09-300000764065us-gaap:AdditionalPaidInCapitalMember2024-09-300000764065us-gaap:RetainedEarningsMember2024-09-300000764065us-gaap:TreasuryStockCommonMember2024-09-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000764065us-gaap:NoncontrollingInterestMember2024-09-300000764065us-gaap:CommonStockMember2022-12-310000764065us-gaap:AdditionalPaidInCapitalMember2022-12-310000764065us-gaap:RetainedEarningsMember2022-12-310000764065us-gaap:TreasuryStockCommonMember2022-12-310000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000764065us-gaap:NoncontrollingInterestMember2022-12-310000764065us-gaap:RetainedEarningsMember2023-01-012023-03-310000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000764065us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100007640652023-01-012023-03-310000764065us-gaap:CommonStockMember2023-01-012023-03-310000764065us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000764065us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000764065us-gaap:CommonStockMember2023-03-310000764065us-gaap:AdditionalPaidInCapitalMember2023-03-310000764065us-gaap:RetainedEarningsMember2023-03-310000764065us-gaap:TreasuryStockCommonMember2023-03-310000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000764065us-gaap:NoncontrollingInterestMember2023-03-3100007640652023-03-310000764065us-gaap:RetainedEarningsMember2023-04-012023-06-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000764065us-gaap:NoncontrollingInterestMember2023-04-012023-06-3000007640652023-04-012023-06-300000764065us-gaap:CommonStockMember2023-04-012023-06-300000764065us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000764065us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000764065us-gaap:CommonStockMember2023-06-300000764065us-gaap:AdditionalPaidInCapitalMember2023-06-300000764065us-gaap:RetainedEarningsMember2023-06-300000764065us-gaap:TreasuryStockCommonMember2023-06-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000764065us-gaap:NoncontrollingInterestMember2023-06-3000007640652023-06-300000764065us-gaap:RetainedEarningsMember2023-07-012023-09-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000764065us-gaap:NoncontrollingInterestMember2023-07-012023-09-300000764065us-gaap:CommonStockMember2023-07-012023-09-300000764065us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000764065us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000764065us-gaap:CommonStockMember2023-09-300000764065us-gaap:AdditionalPaidInCapitalMember2023-09-300000764065us-gaap:RetainedEarningsMember2023-09-300000764065us-gaap:TreasuryStockCommonMember2023-09-300000764065us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000764065us-gaap:NoncontrollingInterestMember2023-09-300000764065clf:StelcoHoldingsIncMemberclf:StelcoHoldingsIncMemberus-gaap:SubsequentEventMember2024-11-010000764065clf:StelcoHoldingsIncMemberus-gaap:SubsequentEventMember2024-11-012024-11-010000764065us-gaap:OtherNoncurrentAssetsMember2024-09-300000764065us-gaap:OtherNoncurrentAssetsMember2023-12-310000764065us-gaap:OtherCurrentLiabilitiesMember2024-09-300000764065us-gaap:OtherCurrentLiabilitiesMember2023-12-310000764065us-gaap:AccountsPayableMember2024-09-300000764065us-gaap:AccountsPayableMember2023-12-310000764065us-gaap:EmployeeSeveranceMember2023-12-310000764065us-gaap:OtherRestructuringMember2023-12-310000764065clf:AssetImpairmentsMember2023-12-310000764065us-gaap:EmployeeSeveranceMember2024-01-012024-03-310000764065us-gaap:OtherRestructuringMember2024-01-012024-03-310000764065clf:AssetImpairmentsMember2024-01-012024-03-310000764065us-gaap:EmployeeSeveranceMember2024-03-310000764065us-gaap:OtherRestructuringMember2024-03-310000764065clf:AssetImpairmentsMember2024-03-310000764065us-gaap:EmployeeSeveranceMember2024-04-012024-06-300000764065us-gaap:OtherRestructuringMember2024-04-012024-06-300000764065clf:AssetImpairmentsMember2024-04-012024-06-300000764065us-gaap:EmployeeSeveranceMember2024-06-300000764065us-gaap:OtherRestructuringMember2024-06-300000764065clf:AssetImpairmentsMember2024-06-300000764065us-gaap:EmployeeSeveranceMember2024-07-012024-09-300000764065us-gaap:OtherRestructuringMember2024-07-012024-09-300000764065clf:AssetImpairmentsMember2024-07-012024-09-300000764065us-gaap:EmployeeSeveranceMember2024-09-300000764065us-gaap:OtherRestructuringMember2024-09-300000764065clf:AssetImpairmentsMember2024-09-300000764065us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-03-310000764065clf:AutomotiveMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:AutomotiveMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:AutomotiveMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:AutomotiveMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:InfrastructureAndManufacturingMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:InfrastructureAndManufacturingMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:InfrastructureAndManufacturingMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:InfrastructureAndManufacturingMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:DistributorsAndConvertersMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:DistributorsAndConvertersMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:DistributorsAndConvertersMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:DistributorsAndConvertersMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:SteelProducersMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:SteelProducersMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:SteelProducersMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:SteelProducersMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:SteelmakingMember2024-07-012024-09-300000764065clf:SteelmakingMember2023-07-012023-09-300000764065clf:SteelmakingMember2024-01-012024-09-300000764065clf:SteelmakingMember2023-01-012023-09-300000764065clf:AutomotiveMemberclf:OtherBusinessesMember2024-07-012024-09-300000764065clf:AutomotiveMemberclf:OtherBusinessesMember2023-07-012023-09-300000764065clf:AutomotiveMemberclf:OtherBusinessesMember2024-01-012024-09-300000764065clf:AutomotiveMemberclf:OtherBusinessesMember2023-01-012023-09-300000764065clf:InfrastructureAndManufacturingMemberclf:OtherBusinessesMember2024-07-012024-09-300000764065clf:InfrastructureAndManufacturingMemberclf:OtherBusinessesMember2023-07-012023-09-300000764065clf:InfrastructureAndManufacturingMemberclf:OtherBusinessesMember2024-01-012024-09-300000764065clf:InfrastructureAndManufacturingMemberclf:OtherBusinessesMember2023-01-012023-09-300000764065clf:DistributorsAndConvertersMemberclf:OtherBusinessesMember2024-07-012024-09-300000764065clf:DistributorsAndConvertersMemberclf:OtherBusinessesMember2023-07-012023-09-300000764065clf:DistributorsAndConvertersMemberclf:OtherBusinessesMember2024-01-012024-09-300000764065clf:DistributorsAndConvertersMemberclf:OtherBusinessesMember2023-01-012023-09-300000764065clf:OtherBusinessesMember2024-07-012024-09-300000764065clf:OtherBusinessesMember2023-07-012023-09-300000764065clf:OtherBusinessesMember2024-01-012024-09-300000764065clf:OtherBusinessesMember2023-01-012023-09-300000764065clf:HotRolledSteelMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:HotRolledSteelMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:HotRolledSteelMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:HotRolledSteelMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:ColdRolledSteelMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:ColdRolledSteelMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:ColdRolledSteelMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:ColdRolledSteelMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:CoatedSteelMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:CoatedSteelMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:CoatedSteelMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:CoatedSteelMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:StainlessAndElectricalSteelMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:StainlessAndElectricalSteelMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:StainlessAndElectricalSteelMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:StainlessAndElectricalSteelMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:PlateSteelMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:PlateSteelMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:PlateSteelMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:PlateSteelMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:SlabAndOtherSteelProductsMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:SlabAndOtherSteelProductsMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:SlabAndOtherSteelProductsMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:SlabAndOtherSteelProductsMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:OtherMemberclf:SteelmakingMember2024-07-012024-09-300000764065clf:OtherMemberclf:SteelmakingMember2023-07-012023-09-300000764065clf:OtherMemberclf:SteelmakingMember2024-01-012024-09-300000764065clf:OtherMemberclf:SteelmakingMember2023-01-012023-09-300000764065clf:OtherMemberclf:OtherBusinessesMember2024-07-012024-09-300000764065clf:OtherMemberclf:OtherBusinessesMember2023-07-012023-09-300000764065clf:OtherMemberclf:OtherBusinessesMember2024-01-012024-09-300000764065clf:OtherMemberclf:OtherBusinessesMember2023-01-012023-09-300000764065us-gaap:OperatingSegmentsMemberclf:SteelmakingMember2024-07-012024-09-300000764065us-gaap:OperatingSegmentsMemberclf:SteelmakingMember2023-07-012023-09-300000764065us-gaap:OperatingSegmentsMemberclf:SteelmakingMember2024-01-012024-09-300000764065us-gaap:OperatingSegmentsMemberclf:SteelmakingMember2023-01-012023-09-300000764065us-gaap:OperatingSegmentsMemberclf:OtherBusinessesMember2024-07-012024-09-300000764065us-gaap:OperatingSegmentsMemberclf:OtherBusinessesMember2023-07-012023-09-300000764065us-gaap:OperatingSegmentsMemberclf:OtherBusinessesMember2024-01-012024-09-300000764065us-gaap:OperatingSegmentsMemberclf:OtherBusinessesMember2023-01-012023-09-300000764065us-gaap:IntersegmentEliminationMember2024-07-012024-09-300000764065us-gaap:IntersegmentEliminationMember2023-07-012023-09-300000764065us-gaap:IntersegmentEliminationMember2024-01-012024-09-300000764065us-gaap:IntersegmentEliminationMember2023-01-012023-09-300000764065clf:EBITDACalculationMember2024-07-012024-09-300000764065clf:EBITDACalculationMember2023-07-012023-09-300000764065clf:EBITDACalculationMember2024-01-012024-09-300000764065clf:EBITDACalculationMember2023-01-012023-09-300000764065clf:AdjustedEBITDACalculationMember2024-07-012024-09-300000764065clf:AdjustedEBITDACalculationMember2023-07-012023-09-300000764065clf:AdjustedEBITDACalculationMember2024-01-012024-09-300000764065clf:AdjustedEBITDACalculationMember2023-01-012023-09-300000764065us-gaap:CorporateAndOtherMember2024-07-012024-09-300000764065us-gaap:CorporateAndOtherMember2023-07-012023-09-300000764065us-gaap:CorporateAndOtherMember2024-01-012024-09-300000764065us-gaap:CorporateAndOtherMember2023-01-012023-09-300000764065us-gaap:OperatingSegmentsMemberclf:SteelmakingMember2024-09-300000764065us-gaap:OperatingSegmentsMemberclf:SteelmakingMember2023-12-310000764065us-gaap:OperatingSegmentsMemberclf:OtherBusinessesMember2024-09-300000764065us-gaap:OperatingSegmentsMemberclf:OtherBusinessesMember2023-12-310000764065us-gaap:IntersegmentEliminationMember2024-09-300000764065us-gaap:IntersegmentEliminationMember2023-12-310000764065us-gaap:OperatingSegmentsMember2024-09-300000764065us-gaap:OperatingSegmentsMember2023-12-310000764065us-gaap:CorporateNonSegmentMember2024-09-300000764065us-gaap:CorporateNonSegmentMember2023-12-310000764065clf:LandlandimprovementsandmineralrightsMember2024-09-300000764065clf:LandlandimprovementsandmineralrightsMember2023-12-310000764065us-gaap:BuildingMember2024-09-300000764065us-gaap:BuildingMember2023-12-310000764065us-gaap:EquipmentMember2024-09-300000764065us-gaap:EquipmentMember2023-12-310000764065us-gaap:OtherAssetsMember2024-09-300000764065us-gaap:OtherAssetsMember2023-12-310000764065us-gaap:ConstructionInProgressMember2024-09-300000764065us-gaap:ConstructionInProgressMember2023-12-310000764065clf:SteelmakingMember2024-09-300000764065clf:SteelmakingMember2023-12-310000764065clf:OtherBusinessesMember2024-09-300000764065clf:OtherBusinessesMember2023-12-310000764065us-gaap:CustomerRelationshipsMember2024-09-300000764065us-gaap:CustomerRelationshipsMember2023-12-310000764065us-gaap:TechnologyBasedIntangibleAssetsMember2024-09-300000764065us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310000764065us-gaap:TrademarksAndTradeNamesMember2024-09-300000764065us-gaap:TrademarksAndTradeNamesMember2023-12-310000764065clf:MiningPermitsMember2024-09-300000764065clf:MiningPermitsMember2023-12-310000764065clf:SupplierRelationshipsMember2024-09-300000764065clf:SupplierRelationshipsMember2023-12-310000764065clf:A67502026SeniorSecuredNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A67502026SeniorSecuredNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065clf:A70002027SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A70002027SeniorNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065clf:A70002027AKSeniorNotesMemberclf:AKSteelMember2024-09-300000764065clf:A70002027AKSeniorNotesMemberclf:AKSteelMember2023-12-310000764065clf:A5.8752027SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A5.8752027SeniorNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065clf:A46252029SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A46252029SeniorNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065clf:A67502030SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A67502030SeniorNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065clf:A48752031SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A48752031SeniorNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065clf:A62502040SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-09-300000764065clf:A62502040SeniorNotesMemberclf:ClevelandCliffsInc.Member2023-12-310000764065us-gaap:RevolvingCreditFacilityMemberclf:ClevelandCliffsInc.Member2024-09-300000764065us-gaap:RevolvingCreditFacilityMemberclf:ClevelandCliffsInc.Member2023-12-310000764065us-gaap:RevolvingCreditFacilityMemberclf:ClevelandCliffsInc.Membersrt:MinimumMember2024-09-300000764065us-gaap:RevolvingCreditFacilityMemberclf:ClevelandCliffsInc.Membersrt:MaximumMember2024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-03-180000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-08-160000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-08-162024-08-160000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Membersrt:MinimumMember2024-01-012024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Membersrt:MaximumMember2024-01-012024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Memberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-01-012024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Memberclf:DebtInstrumentRedemptionPeriodOneUponEquityIssuanceMember2024-01-012024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Memberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2024-01-012024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Memberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2024-01-012024-09-300000764065clf:A7.0002032SeniorNotesMemberclf:ClevelandCliffsInc.Member2024-01-012024-09-300000764065us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-130000764065us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-09-300000764065us-gaap:RevolvingCreditFacilityMember2024-09-300000764065us-gaap:LetterOfCreditMember2024-09-300000764065us-gaap:BridgeLoanMemberus-gaap:LineOfCreditMember2024-09-300000764065us-gaap:BridgeLoanMemberus-gaap:LineOfCreditMember2024-09-130000764065clf:A67502026SeniorSecuredNotesMemberclf:ClevelandCliffsInc.Member2024-03-182024-03-180000764065clf:A67502026SeniorSecuredNotesMemberclf:ClevelandCliffsInc.Member2024-04-032024-04-030000764065us-gaap:PensionPlansDefinedBenefitMember2024-07-012024-09-300000764065us-gaap:PensionPlansDefinedBenefitMember2023-07-012023-09-300000764065us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-09-300000764065us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-09-300000764065us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-07-012024-09-300000764065us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-07-012023-09-300000764065us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-09-300000764065us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-09-300000764065us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-09-300000764065us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-09-300000764065us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000764065us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000764065us-gaap:FairValueInputsLevel2Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:LineOfCreditMember2024-09-300000764065us-gaap:FairValueInputsLevel2Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:LineOfCreditMember2024-09-300000764065us-gaap:FairValueInputsLevel2Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:LineOfCreditMember2023-12-310000764065us-gaap:FairValueInputsLevel2Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:LineOfCreditMember2023-12-310000764065us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-09-300000764065us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300000764065us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000764065us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000764065srt:NaturalGasPerThousandCubicFeetMemberus-gaap:CommodityContractMember2024-09-300000764065srt:NaturalGasPerThousandCubicFeetMemberus-gaap:CommodityContractMember2023-12-310000764065us-gaap:ElectricityMemberus-gaap:CommodityContractMember2024-09-300000764065us-gaap:ElectricityMemberus-gaap:CommodityContractMember2023-12-310000764065us-gaap:OtherCurrentAssetsMember2024-09-300000764065us-gaap:OtherCurrentAssetsMember2023-12-310000764065us-gaap:OtherNoncurrentLiabilitiesMember2024-09-300000764065us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310000764065clf:StelcoHoldingsIncMember2024-07-122024-07-120000764065currency:CADus-gaap:ForeignExchangeOptionMember2024-09-3000007640652022-02-1000007640652024-04-220000764065us-gaap:CommonStockMember2024-01-012024-09-300000764065us-gaap:TreasuryStockCommonMember2024-01-012024-09-300000764065us-gaap:CommonStockMember2023-01-012023-09-300000764065us-gaap:TreasuryStockCommonMember2023-01-012023-09-300000764065us-gaap:SeriesAPreferredStockMember2024-09-300000764065us-gaap:SeriesBPreferredStockMember2024-09-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-07-012024-09-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012023-09-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-09-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-09-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-09-300000764065us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-09-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-06-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-06-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-12-310000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-12-310000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-07-012024-09-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-07-012023-09-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-01-012024-09-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-01-012023-09-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-09-300000764065us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-09-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-07-012024-09-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012023-09-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-09-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-09-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-09-300000764065us-gaap:AccumulatedDefinedBenefitPlansAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-09-300000764065clf:SunCokeMiddletownMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-07-012024-09-300000764065clf:SunCokeMiddletownMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-01-012024-09-300000764065clf:SunCokeMiddletownMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-07-012023-09-300000764065clf:SunCokeMiddletownMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-09-300000764065clf:SunCokeMiddletownMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-09-300000764065clf:SunCokeMiddletownMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310000764065us-gaap:StockCompensationPlanMember2024-01-012024-09-300000764065us-gaap:StockCompensationPlanMember2024-07-012024-09-300000764065us-gaap:StockCompensationPlanMember2023-01-012023-09-300000764065us-gaap:StockCompensationPlanMember2023-07-012023-09-300000764065us-gaap:SuretyBondMember2024-09-300000764065clf:A6.8752029SeniorGuaranteedNoteMemberus-gaap:SubsequentEventMember2024-10-220000764065clf:A7.3752033SeniorGuaranteedNoteMemberus-gaap:SubsequentEventMember2024-10-220000764065us-gaap:BridgeLoanMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | | | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended September 30, 2024

OR

| | | | | | | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to .

Commission File Number: 1-8944

CLEVELAND-CLIFFS INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | | | | | | | |

| Ohio | | 34-1464672 | |

| (State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) | |

| | | | |

| 200 Public Square, | Cleveland, | Ohio | | 44114-2315 | |

| (Address of Principal Executive Offices) | | (Zip Code) | |

Registrant’s telephone number, including area code: (216) 694-5700

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common shares, par value $0.125 per share | | CLF | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The number of shares outstanding of the registrant’s common shares, par value $0.125 per share, was 493,943,553 as of November 5, 2024.

TABLE OF CONTENTS | | | | | | | | | | | | | | | | | |

| | | Page Number |

| | | | | |

| DEFINITIONS | | | |

| | | |

| PART I - FINANCIAL INFORMATION | | | |

| ITEM 1. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | | |

| | STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED FINANCIAL POSITION AS OF SEPTEMBER 30, 2024 AND DECEMBER 31, 2023 | | | |

| | STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED OPERATIONS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 | | | |

| | STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED COMPREHENSIVE INCOME (LOSS) FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 | | | |

| | STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED CASH FLOWS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 | | | |

| | STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED CHANGES IN EQUITY FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023 | | | |

| | NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | | | |

| ITEM 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | | |

| ITEM 4. | CONTROLS AND PROCEDURES | | | |

| | | |

| PART II - OTHER INFORMATION | | | |

| ITEM 1. | LEGAL PROCEEDINGS | | | |

| ITEM 1A. | RISK FACTORS | | | |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | | | |

| ITEM 4. | MINE SAFETY DISCLOSURES | | | |

| ITEM 5. | OTHER INFORMATION | | | |

| ITEM 6. | EXHIBITS | | | |

| | | | | |

| SIGNATURES | | | |

| | | |

DEFINITIONS

The following abbreviations or acronyms are used in the text. References in this report to the “Company,” “we,” “us,” “our,” "Cleveland-Cliffs" and “Cliffs” are to Cleveland-Cliffs Inc. and subsidiaries, collectively. Unless otherwise indicated, references to "$" is to United States currency.

| | | | | | | | |

| Abbreviation or acronym | | Term |

| 7.000% 2032 Senior Notes | | 7.000% Senior Guaranteed Notes due 2032 issued by Cleveland-Cliffs Inc. on March 18, 2024 and August 16, 2024 in an aggregate principal amount of $1,425 million |

| ABL Facility | | Asset-Based Revolving Credit Agreement, dated as of March 13, 2020, among Cleveland-Cliffs Inc., the lenders party thereto from time to time and Bank of America, N.A., as administrative agent, as amended as of March 27, 2020, December 9, 2020, December 17, 2021, June 9, 2023, July 31, 2024, and September 13, 2024, and as may be further amended from time to time |

| Adjusted EBITDA | | EBITDA, excluding certain items such as EBITDA of noncontrolling interests, Weirton indefinite idle, extinguishment of debt, acquisition-related costs and adjustments, arbitration decision, and other, net |

| Arrangement Agreement | | Arrangement Agreement, by and between Stelco, Purchaser and Cleveland-Cliffs Inc., dated July 14, 2024 |

| AOCI | | Accumulated other comprehensive income (loss) |

| ASU | | Accounting Standards Update |

| BOF | | Basic oxygen furnace |

| Bridge Facility | | Financing arrangement contemplated by the Commitment Letter under which Cleveland-Cliffs Inc. had the option to borrow certain funds in relation to the Stelco Acquisition |

| CHIPS Act | | The Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022 |

CO2e | | Carbon dioxide equivalent |

| Commitment Letter | | Commitment Letter, dated as of July 14, 2024, pursuant to which Wells Fargo Bank National Association, Wells Fargo Securities, LLC, and JP Morgan Chase Bank, N.A. committed to providing Cleveland-Cliffs Inc. with financing under a Bridge Facility |

| Dodd-Frank Act | | Dodd-Frank Wall Street Reform and Consumer Protection Act |

| DOE | | U.S. Department of Energy |

| EAF | | Electric arc furnace |

| EBITDA | | Earnings before interest, taxes, depreciation and amortization |

| EPA | | U.S. Environmental Protection Agency |

| EPS | | Earnings per share |

| EV | | Electric vehicle |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| FASB | | Financial Accounting Standards Board |

| FMSH Act | | Federal Mine Safety and Health Act of 1977, as amended |

| GAAP | | Accounting principles generally accepted in the United States |

| GHG | | Greenhouse gas |

| GOES | | Grain oriented electrical steel |

| HBI | | Hot briquetted iron |

| HRC | | Hot-rolled coil steel |

| Inflation Reduction Act | | Inflation Reduction Act of 2022 |

| Infrastructure and Jobs Act | | Infrastructure Investment and Jobs Act of 2021 |

| Metric ton (mt) | | 2,205 pounds |

| MSHA | | Mine Safety and Health Administration of the U.S. Department of Labor |

| Net ton (nt) | | 2,000 pounds |

| NOES | | Non-oriented electrical steel |

OCED | | Office of Clean Energy Demonstrations |

| OPEB | | Other postretirement benefits |

| Platts 62% price | | Platts IODEX 62% Fe Fines CFR North China |

| Purchaser | | 13421422 Canada Inc., a Canadian corporation and a direct, wholly-owned subsidiary of Cleveland-Cliffs Inc. |

| SEC | | U.S. Securities and Exchange Commission |

| Section 232 | | Section 232 of the Trade Expansion Act of 1962 (as amended by the Trade Act of 1974) |

| Securities Act | | Securities Act of 1933, as amended |

| Stelco | | Stelco Holdings Inc., a Canadian corporation |

| Stelco Acquisition | | The acquisition of all of the outstanding common shares of Stelco by the Company, as provided for in the Arrangement Agreement |

| SunCoke Middletown | | Middletown Coke Company, LLC, a subsidiary of SunCoke Energy, Inc. |

| USMCA | | United States-Mexico-Canada Agreement |

| USW | | United Steelworkers |

| VIE | | Variable interest entity |

PART I

| | |

|

| ITEM 1. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED FINANCIAL POSITION

CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

| | | | | | | | | | | |

| (In millions, except share information) | September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 39 | | | $ | 198 | |

| Accounts receivable, net | 1,583 | | | 1,840 | |

| Inventories | 4,236 | | | 4,460 | |

| Other current assets | 169 | | | 138 | |

| Total current assets | 6,027 | | | 6,636 | |

| Non-current assets: | | | |

| Property, plant and equipment, net | 8,687 | | | 8,895 | |

| Goodwill | 1,005 | | | 1,005 | |

| Pension and OPEB assets | 378 | | | 329 | |

| Other non-current assets | 699 | | | 672 | |

| TOTAL ASSETS | $ | 16,796 | | | $ | 17,537 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,983 | | | $ | 2,099 | |

| Accrued employment costs | 413 | | | 511 | |

| Accrued expenses | 379 | | | 380 | |

| Other current liabilities | 480 | | | 518 | |

| Total current liabilities | 3,255 | | | 3,508 | |

| Non-current liabilities: | | | |

| Long-term debt | 3,774 | | | 3,137 | |

| Pension and OPEB liabilities | 666 | | | 821 | |

| Deferred income taxes | 567 | | | 639 | |

| Other non-current liabilities | 1,439 | | | 1,310 | |

| TOTAL LIABILITIES | 9,701 | | | 9,415 | |

| Commitments and contingencies (See Note 17) | | | |

| Equity: | | | |

Common shares - par value $0.125 per share | | | |

Authorized - 1,200,000,000 shares (2023 - 1,200,000,000 shares); | | | |

Issued - 531,051,530 shares (2023 - 531,051,530 shares); | | | |

Outstanding - 468,067,482 shares (2023 - 504,886,773 shares) | 66 | | | 66 | |

| Capital in excess of par value of shares | 4,875 | | | 4,861 | |

| Retained earnings | 1,426 | | | 1,733 | |

Cost of 62,984,048 common shares in treasury (2023 - 26,164,757 shares) | (1,153) | | | (430) | |

| Accumulated other comprehensive income | 1,640 | | | 1,657 | |

| Total Cliffs shareholders' equity | 6,854 | | | 7,887 | |

| Noncontrolling interests | 241 | | | 235 | |

| TOTAL EQUITY | 7,095 | | | 8,122 | |

| TOTAL LIABILITIES AND EQUITY | $ | 16,796 | | | $ | 17,537 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED OPERATIONS

CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

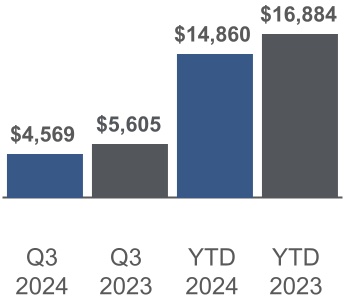

| Revenues | $ | 4,569 | | | $ | 5,605 | | | $ | 14,860 | | | $ | 16,884 | |

| Operating costs: | | | | | | | |

| Cost of goods sold | (4,673) | | | (5,125) | | | (14,517) | | | (15,661) | |

| Selling, general and administrative expenses | (112) | | | (139) | | | (347) | | | (415) | |

| Acquisition-related costs | (14) | | | (5) | | | (14) | | | (5) | |

| Restructuring and other charges | (2) | | | — | | | (131) | | | — | |

| Asset impairments | — | | | — | | | (79) | | | — | |

| Miscellaneous – net | (27) | | | (11) | | | (63) | | | (26) | |

| Total operating costs | (4,828) | | | (5,280) | | | (15,151) | | | (16,107) | |

| Operating income (loss) | (259) | | | 325 | | | (291) | | | 777 | |

| Other income (expense): | | | | | | | |

| Interest expense, net | (102) | | | (70) | | | (235) | | | (226) | |

| Loss on extinguishment of debt | — | | | — | | | (27) | | | — | |

| Net periodic benefit credits other than service cost component | 62 | | | 50 | | | 184 | | | 150 | |

| Changes in fair value of foreign currency contracts, net | (7) | | | — | | | (7) | | | — | |

| Other non-operating income (expense) | — | | | (2) | | | 3 | | | 4 | |

| Total other expense | (47) | | | (22) | | | (82) | | | (72) | |

| Income (loss) from continuing operations before income taxes | (306) | | | 303 | | | (373) | | | 705 | |

| Income tax benefit (expense) | 76 | | | (29) | | | 99 | | | (118) | |

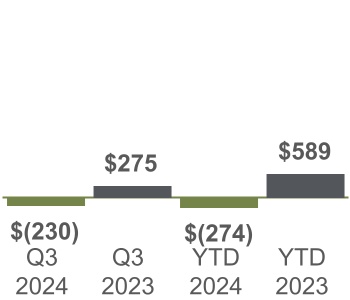

| Income (loss) from continuing operations | (230) | | | 274 | | | (274) | | | 587 | |

| Income from discontinued operations, net of tax | — | | | 1 | | | — | | | 2 | |

| Net income (loss) | (230) | | | 275 | | | (274) | | | 589 | |

| Income attributable to noncontrolling interests | (12) | | | (11) | | | (33) | | | (35) | |

| Net income (loss) attributable to Cliffs shareholders | $ | (242) | | | $ | 264 | | | $ | (307) | | | $ | 554 | |

| | | | | | | |

| Earnings (loss) per common share attributable to Cliffs shareholders - basic | | | | | | | |

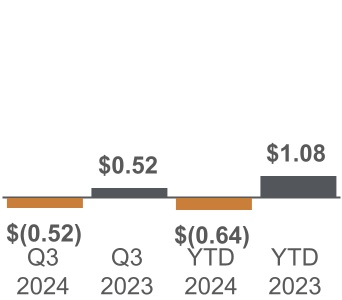

| Continuing operations | $ | (0.52) | | | $ | 0.52 | | | $ | (0.64) | | | $ | 1.08 | |

| Discontinued operations | — | | | — | | | — | | | — | |

| $ | (0.52) | | | $ | 0.52 | | | $ | (0.64) | | | $ | 1.08 | |

| Earnings (loss) per common share attributable to Cliffs shareholders - diluted | | | | | | | |

| Continuing operations | $ | (0.52) | | | $ | 0.52 | | | $ | (0.64) | | | $ | 1.08 | |

| Discontinued operations | — | | | — | | | — | | | — | |

| $ | (0.52) | | | $ | 0.52 | | | $ | (0.64) | | | $ | 1.08 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED COMPREHENSIVE INCOME (LOSS)

CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) | $ | (230) | | | $ | 275 | | | $ | (274) | | | $ | 589 | |

| Other comprehensive income (loss): | | | | | | | |

| Changes in pension and OPEB, net of tax | (29) | | | (27) | | | (86) | | | (80) | |

| Changes in derivative financial instruments, net of tax | 2 | | | 31 | | | 69 | | | (103) | |

| Changes in foreign currency translation | 1 | | | — | | | — | | | — | |

| Total other comprehensive income (loss) | (26) | | | 4 | | | (17) | | | (183) | |

| Comprehensive income (loss) | (256) | | | 279 | | | (291) | | | 406 | |

| Comprehensive income attributable to noncontrolling interests | (12) | | | (11) | | | (33) | | | (35) | |

| Comprehensive income (loss) attributable to Cliffs shareholders | $ | (268) | | | $ | 268 | | | $ | (324) | | | $ | 371 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED CASH FLOWS

CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 |

| OPERATING ACTIVITIES | | | |

| Net income (loss) | $ | (274) | | | $ | 589 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation, depletion and amortization | 693 | | | 738 | |

| Restructuring and other charges | 131 | | | — | |

| Asset impairments | 79 | | | — | |

| Pension and OPEB credits | (157) | | | (119) | |

| Loss on extinguishment of debt | 27 | | | — | |

| Other | 66 | | | 253 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 258 | | | (164) | |

| Inventories | 190 | | | 538 | |

| Income taxes | (46) | | | 16 | |

| Pension and OPEB payments and contributions | (162) | | | (84) | |

| Payables, accrued employment and accrued expenses | (217) | | | (95) | |

| Other, net | (11) | | | (57) | |

| Net cash provided by operating activities | 577 | | | 1,615 | |

| INVESTING ACTIVITIES | | | |

| Purchase of property, plant and equipment | (490) | | | (481) | |

| Other investing activities | 13 | | | 11 | |

| Net cash used by investing activities | (477) | | | (470) | |

| FINANCING ACTIVITIES | | | |

| Repurchase of common shares | (733) | | | (152) | |

| Proceeds from issuance of senior notes | 1,421 | | | 750 | |

| Repayments of senior notes | (845) | | | — | |

| Borrowings (repayments) under credit facilities, net | 47 | | | (1,539) | |

| Debt issuance costs | (73) | | | (34) | |

| Other financing activities | (76) | | | (165) | |

| Net cash used by financing activities | (259) | | | (1,140) | |

| Net increase (decrease) in cash and cash equivalents | (159) | | | 5 | |

| Cash and cash equivalents at beginning of period | 198 | | | 26 | |

| Cash and cash equivalents at end of period | $ | 39 | | | $ | 31 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

STATEMENTS OF UNAUDITED CONDENSED CONSOLIDATED CHANGES IN EQUITY

CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Number of

Common Shares Outstanding | | Par Value of Common

Shares Issued | | Capital in

Excess of

Par Value

of Shares | | Retained

Earnings | | Common

Shares

in

Treasury | | AOCI | | Non-Controlling Interest | | Total |

| December 31, 2023 | 504.9 | | | $ | 66 | | | $ | 4,861 | | | $ | 1,733 | | | $ | (430) | | | $ | 1,657 | | | $ | 235 | | | $ | 8,122 | |

| Comprehensive income (loss) | — | | | — | | | — | | | (67) | | | — | | | (9) | | | 14 | | | (62) | |

| Common stock repurchases, net of excise tax | (30.4) | | | — | | | — | | | — | | | (615) | | | — | | | — | | | (615) | |

| Stock and other incentive plans | 1.0 | | | — | | | (10) | | | — | | | 15 | | | — | | | — | | | 5 | |

| Net distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (8) | | | (8) | |

| March 31, 2024 | 475.5 | | | $ | 66 | | | $ | 4,851 | | | $ | 1,666 | | | $ | (1,030) | | | $ | 1,648 | | | $ | 241 | | | $ | 7,442 | |

| Comprehensive income | — | | | — | | | — | | | 2 | | | — | | | 18 | | | 7 | | | 27 | |

| Common stock repurchases, net of excise tax | (7.5) | | | — | | | — | | | — | | | (125) | | | — | | | — | | | (125) | |

| Stock and other incentive plans | — | | | — | | | 13 | | | — | | | 1 | | | — | | | — | | | 14 | |

| Net distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | 14 | | | 14 | |

| June 30, 2024 | 468.0 | | | $ | 66 | | | $ | 4,864 | | | $ | 1,668 | | | $ | (1,154) | | | $ | 1,666 | | | $ | 262 | | | $ | 7,372 | |

| Comprehensive income (loss) | — | | | — | | | — | | | (242) | | | — | | | (26) | | | 12 | | | (256) | |

| | | | | | | | | | | | | | | |

| Stock and other incentive plans | 0.1 | | | — | | | 11 | | | — | | | 1 | | | — | | | — | | | 12 | |

| Net distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (33) | | | (33) | |

| September 30, 2024 | 468.1 | | | $ | 66 | | | $ | 4,875 | | | $ | 1,426 | | | $ | (1,153) | | | $ | 1,640 | | | $ | 241 | | | $ | 7,095 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Number of

Common Shares Outstanding | | Par Value of Common

Shares Issued | | Capital in

Excess of

Par Value

of Shares | | Retained

Earnings | | Common

Shares

in

Treasury | | AOCI | | Non-Controlling Interest | | Total |

| December 31, 2022 | 513.3 | | | $ | 66 | | | $ | 4,871 | | | $ | 1,334 | | | $ | (310) | | | $ | 1,830 | | | $ | 251 | | | $ | 8,042 | |

| Comprehensive income (loss) | — | | | — | | | — | | | (57) | | | — | | | (179) | | | 15 | | | (221) | |

| Stock and other incentive plans | 1.8 | | | — | | | (39) | | | — | | | 30 | | | — | | | — | | | (9) | |

| Net distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (19) | | | (19) | |

| March 31, 2023 | 515.1 | | | $ | 66 | | | $ | 4,832 | | | $ | 1,277 | | | $ | (280) | | | $ | 1,651 | | | $ | 247 | | | $ | 7,793 | |

| Comprehensive income (loss) | — | | | — | | | — | | | 347 | | | — | | | (8) | | | 9 | | | 348 | |

| Common stock repurchases, net of excise tax | (6.5) | | | — | | | — | | | — | | | (95) | | | — | | | — | | | (95) | |

| Stock and other incentive plans | 0.1 | | | — | | | 9 | | | — | | | 3 | | | — | | | — | | | 12 | |

| Net distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (14) | | | (14) | |

| June 30, 2023 | 508.7 | | | $ | 66 | | | $ | 4,841 | | | $ | 1,624 | | | $ | (372) | | | $ | 1,643 | | | $ | 242 | | | $ | 8,044 | |

| Comprehensive income | — | | | — | | | — | | | 264 | | | — | | | 4 | | | 11 | | 279 | |

| Common stock repurchases, net of excise tax | (3.9) | | | — | | | — | | | — | | | (59) | | | — | | | — | | | (59) | |

| Stock and other incentive plans | — | | | — | | | 9 | | | — | | | — | | | — | | | — | | | 9 | |

| Net distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (9) | | | (9) | |

| September 30, 2023 | 504.8 | | | $ | 66 | | | $ | 4,850 | | | $ | 1,888 | | | $ | (431) | | | $ | 1,647 | | | $ | 244 | | | $ | 8,264 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CLEVELAND-CLIFFS INC. AND SUBSIDIARIES

NOTE 1 - BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

BUSINESS, CONSOLIDATION AND PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with SEC rules and regulations and, in the opinion of management, include all adjustments (consisting of normal recurring adjustments) necessary to present fairly the financial position, results of operations, comprehensive income (loss), cash flows and changes in equity for the periods presented. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Management bases its estimates on various assumptions and historical experience, which are believed to be reasonable; however, due to the inherent nature of estimates, actual results may differ significantly due to changed conditions or assumptions. The results of operations for the three and nine months ended September 30, 2024 are not necessarily indicative of results to be expected for the year ending December 31, 2024 or any other future period. Certain prior period amounts have been reclassified to conform with the current year presentation. These unaudited condensed consolidated financial statements should be read in conjunction with the financial statements and notes included in our Annual Report on Form 10-K for the year ended December 31, 2023.

NATURE OF BUSINESS

We are a leading North America-based steel producer with focus on value-added sheet products, particularly for the automotive industry. We are also a leading producer of electrical steels referred to as GOES and NOES in the U.S. We are vertically integrated from the mining of iron ore, production of pellets and direct reduced iron, and processing of ferrous scrap through primary steelmaking and downstream finishing, stamping, tooling, and tubing. Headquartered in Cleveland, Ohio, with the closing of the Stelco Acquisition, we employ approximately 30,000 people across our operations in the United States and Canada.

ACQUISITION OF STELCO

On November 1, 2024, pursuant to the terms of the Arrangement Agreement announced on July 15, 2024, we completed the Stelco Acquisition. In connection with closing, Stelco shareholders received CAD $60.00 in cash and 0.454 shares of Cliffs common stock per share of Stelco common stock.

BUSINESS OPERATIONS

We are organized into four operating segments based on differentiated products – Steelmaking, Tubular, Tooling and Stamping, and European Operations. We primarily operate through one reportable segment – the Steelmaking segment.

BASIS OF CONSOLIDATION

The unaudited condensed consolidated financial statements consolidate our accounts and the accounts of our wholly owned subsidiaries, all subsidiaries in which we have a controlling interest and VIEs for which we are the primary beneficiary. All intercompany transactions and balances are eliminated upon consolidation.

INVESTMENTS IN AFFILIATES

We have investments in several businesses accounted for using the equity method of accounting. These investments are included within our Steelmaking segment. Our investment in affiliates of $117 million and $123 million as of September 30, 2024 and December 31, 2023, respectively, was classified in Other non-current assets.

SIGNIFICANT ACCOUNTING POLICIES

A detailed description of our significant accounting policies can be found in the audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC. There have been no material changes in our significant accounting policies and estimates from those disclosed therein.

RECENT ACCOUNTING PRONOUNCEMENTS AND LEGISLATION

In September 2022, the FASB issued ASU No. 2022-04, Liabilities - Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Program Obligations. This guidance requires annual and interim disclosure of the key terms of outstanding supplier finance programs and a roll-forward of the related obligations. The new standard does not affect the recognition, measurement or financial statement presentation of the supplier finance program obligations. We have adopted this standard, except for the amendment on roll-forward information, which is effective for fiscal years beginning after December 15, 2023. Refer to NOTE 2 - SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION for further information.

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. This guidance requires additional annual and interim disclosures for reportable segments. This new standard does not affect the recognition, measurement or financial statement presentation. The amendments are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This guidance requires additional annual and interim disclosures for income taxes. This new standard does not affect the

recognition, measurement or financial statement presentation. The amendments are effective for fiscal years beginning after December 15, 2024.

NOTE 2 - SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION

ALLOWANCE FOR CREDIT LOSSES

The following is a roll-forward of our allowance for credit losses associated with Accounts receivable, net:

| | | | | | | | | | | |

| (In millions) | 2024 | | 2023 |

| Allowance for credit losses as of January 1 | $ | (5) | | | $ | (4) | |

| Decrease (increase) in allowance | 1 | | | (3) | |

| Allowance for credit losses as of September 30 | $ | (4) | | | $ | (7) | |

INVENTORIES

The following table presents the detail of our Inventories on the Statements of Unaudited Condensed Consolidated Financial Position:

| | | | | | | | | | | |

| (In millions) | September 30,

2024 | | December 31,

2023 |

| Product inventories | | | |

| Finished and semi-finished goods | $ | 2,319 | | | $ | 2,573 | |

| Raw materials | 1,486 | | | 1,476 | |

| Total product inventories | 3,805 | | | 4,049 | |

| Manufacturing supplies and critical spares | 431 | | | 411 | |

| Inventories | $ | 4,236 | | | $ | 4,460 | |

SUPPLY CHAIN FINANCE PROGRAMS

We negotiate payment terms directly with our suppliers for the purchase of goods and services. We currently offer voluntary supply chain finance programs that enable our suppliers to sell their Cliffs receivables to financial intermediaries, at the sole discretion of both the suppliers and financial intermediaries. No guarantees are provided by us or our subsidiaries under the supply chain finance programs. The supply chain finance programs allow our suppliers to be paid by the financial intermediaries earlier than the due date on the applicable invoice. Supply chain finance programs that extend terms or provide us an economic benefit are classified as short-term financings. As of September 30, 2024 and December 31, 2023, we had $27 million and $21 million, respectively, deemed as short-term financings that are classified in Other current liabilities. Additionally, as of September 30, 2024 and December 31, 2023, we had $71 million and $91 million, respectively, classified as Accounts payable.

WEIRTON INDEFINITE IDLE

On February 15, 2024, we announced the indefinite idle of our tinplate production plant located in Weirton, West Virginia. As of September 30, 2024, we have incurred $212 million of charges related to the idle and estimate that we will incur nominal future charges to Restructuring and other charges, primarily related to employee related costs which are expected to be incurred by the end of 2024.

The following table represents a reconciliation of our accrued liabilities related to the Weirton indefinite idle:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Employee- Related Costs | | Exit Costs | | Asset Impairment | | Total |

| Balance as of December 31, 2023 | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Costs incurred1 | 58 | | | 48 | | | 64 | | | 170 | |

| Cash payments | — | | | (2) | | | — | | | (2) | |

| Non-cash | — | | | — | | | (64) | | | (64) | |

| Balance as of March 31, 2024 | $ | 58 | | | $ | 46 | | | $ | — | | | $ | 104 | |

Costs incurred2 | 23 | | | 2 | | | 15 | | | 40 | |

| Cash payments | (8) | | | (10) | | | — | | | (18) | |

| Non-cash | — | | | — | | | (15) | | | (15) | |

| Balance as of June 30, 2024 | $ | 73 | | | $ | 38 | | | $ | — | | | $ | 111 | |

Costs incurred3 | — | | | 2 | | | — | | | 2 | |

| Cash payments | (10) | | | (11) | | | — | | | (21) | |

| | | | | | | |

| Balance as of September 30, 2024 | $ | 63 | | | $ | 29 | | | $ | — | | | $ | 92 | |

| | | | | | | |

1 Of the $170 million of cost incurred, $104 million was recorded in Restructuring and other charges, $64 million was recorded in Asset impairments and $2 million was recorded in Net periodic benefit credits other than service cost component. |

2 Of the $40 million of costs incurred, $25 million was recorded in Restructuring and other charges and $15 million was recorded in Asset impairments. |

3 Costs incurred of $2 million were recorded in Restructuring and other charges. |

CASH FLOW INFORMATION

A reconciliation of capital additions to cash paid for capital expenditures is as follows:

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 |

| Capital additions | $ | 557 | | | $ | 508 | |

| Less: | | | |

| Non-cash accruals | (58) | | | (98) | |

| Equipment financed with seller | 50 | | | 47 | |

| Right-of-use assets - finance leases | 75 | | | 78 | |

| Cash paid for capital expenditures including deposits | $ | 490 | | | $ | 481 | |

Cash payments (receipts) for income taxes and interest are as follows:

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 |

| Income taxes paid | $ | 13 | | | $ | 91 | |

| Income tax refunds | (5) | | | (142) | |

Interest paid on debt obligations net of capitalized interest1 | 193 | | | 202 | |

| | | |

1 Capitalized interest was $11 million and $8 million for the nine months ended September 30, 2024 and 2023, respectively. |

NOTE 3 - REVENUES

We generate our revenue through product sales, in which shipping terms indicate when we have fulfilled our performance obligations and transferred control of products to our customer. Our revenue transactions consist of a single performance obligation to transfer promised goods. Our contracts with customers define the mechanism for determining the sales price, which is generally fixed upon transfer of control, but the contracts generally do not impose a specific quantity on either party. Quantities to be delivered to the customer are determined at a point near the date of delivery through purchase orders or other written instructions we receive from the customer. Spot market sales are made through purchase orders or other written instructions. We consider our performance obligation to be complete and recognize revenue when control transfers in accordance with shipping terms.

Revenue is measured as the amount of consideration we expect to receive in exchange for transferring product. We reduce the amount of revenue recognized for estimated returns and other customer credits, such as discounts and volume rebates, based on the expected value to be realized. Payment terms are consistent with terms standard to the markets we serve. Sales taxes collected from customers are excluded from revenues.

The following table represents our Revenues by market:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Steelmaking: | | | | | | | |

| Direct automotive | $ | 1,334 | | | $ | 1,958 | | | $ | 4,411 | | | $ | 5,808 | |

| Infrastructure and manufacturing | 1,160 | | | 1,427 | | | 3,973 | | | 4,315 | |

| Distributors and converters | 1,317 | | | 1,321 | | | 4,131 | | | 4,020 | |

Steel producers | 608 | | | 737 | | | 1,846 | | | 2,234 | |

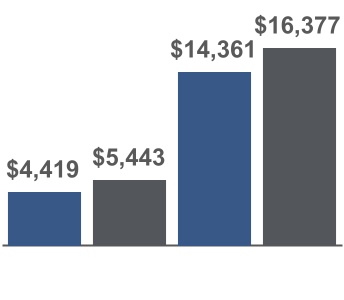

| Total Steelmaking | 4,419 | | | 5,443 | | | 14,361 | | | 16,377 | |

| Other Businesses: | | | | | | | |

| Direct automotive | 123 | | | 133 | | | 411 | | | 415 | |

| Infrastructure and manufacturing | 9 | | | 9 | | | 29 | | | 29 | |

| Distributors and converters | 18 | | | 20 | | | 59 | | | 63 | |

| Total Other Businesses | 150 | | | 162 | | | 499 | | | 507 | |

| Total revenues | $ | 4,569 | | | $ | 5,605 | | | $ | 14,860 | | | $ | 16,884 | |

The following tables represent our Revenues by product line:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Steelmaking: | | | | | | | |

| Hot-rolled steel | $ | 1,003 | | | $ | 1,269 | | | $ | 3,246 | | | $ | 3,747 | |

| Cold-rolled steel | 671 | | | 651 | | | 2,131 | | | 2,038 | |

| Coated steel | 1,377 | | | 1,748 | | | 4,546 | | | 5,154 | |

| Stainless and electrical steel | 449 | | | 568 | | | 1,390 | | | 1,757 | |

| Plate | 237 | | | 382 | | | 887 | | | 1,112 | |

| Slab and other steel products | 276 | | | 322 | | | 929 | | | 1,015 | |

| Other | 406 | | | 503 | | | 1,232 | | | 1,554 | |

| Total Steelmaking | 4,419 | | | 5,443 | | | 14,361 | | | 16,377 | |

| Other Businesses: | | | | | | | |

| Other | 150 | | | 162 | | | 499 | | | 507 | |

| Total revenues | $ | 4,569 | | | $ | 5,605 | | | $ | 14,860 | | | $ | 16,884 | |

NOTE 4 - SEGMENT REPORTING

We are vertically integrated from mined raw materials and direct reduced iron and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling and tubing. We are organized into four operating segments based on our differentiated products – Steelmaking, Tubular, Tooling and Stamping, and European Operations. We have one reportable segment – Steelmaking. The operating segment results of our Tubular, Tooling and Stamping, and European Operations that do not constitute reportable segments are combined and disclosed in the Other Businesses category. Our Steelmaking segment operates as a leading North America-based steel producer supported by being the largest iron ore pellet producer as well as a leading prime scrap processor, primarily serving the automotive, distributors and converters, and infrastructure and manufacturing markets. Our Other Businesses primarily include the operating segments that provide customer solutions with carbon and stainless steel tubing products, advanced-engineered solutions, tool design and build, hot- and cold-stamped steel components, and complex assemblies. All intersegment transactions were eliminated in consolidation. We allocate Corporate Selling, general and administrative expenses to our operating segments.

We evaluate performance on an operating segment basis, as well as a consolidated basis, based on Adjusted EBITDA, which is a non-GAAP measure. This measure is used by management, investors, lenders and other external users of our financial statements to assess our operating performance and to compare operating performance to other companies in the steel industry, showing results exclusive of certain non-recurring and/or non-cash items. In addition, management believes Adjusted EBITDA is a useful measure to assess the earnings power of the business without the impact of capital structure and can be used to assess our ability to service debt and fund future capital expenditures in the business.

Our results by segment are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Steelmaking | $ | 4,419 | | | $ | 5,443 | | | $ | 14,361 | | | $ | 16,377 | |

| Other Businesses | 150 | | | 162 | | | 499 | | | 507 | |

| Total revenues | $ | 4,569 | | | $ | 5,605 | | | $ | 14,860 | | | $ | 16,884 | |

| | | | | | | |

| Adjusted EBITDA: | | | | | | | |

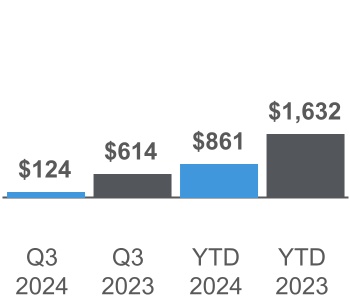

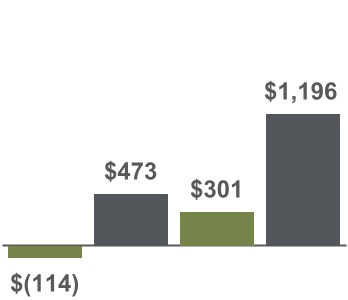

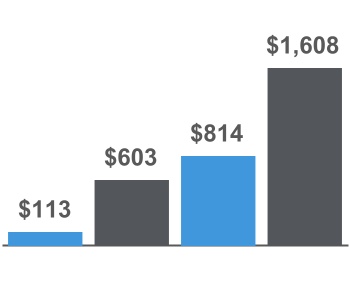

| Steelmaking | $ | 113 | | | $ | 603 | | | $ | 814 | | | $ | 1,608 | |

| Other Businesses | 8 | | | 9 | | | 43 | | | 32 | |

| Eliminations | 3 | | | 2 | | | 4 | | | (8) | |

| Total Adjusted EBITDA | $ | 124 | | | $ | 614 | | | $ | 861 | | | $ | 1,632 | |

The following table provides a reconciliation of our consolidated Net income (loss) to total Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) | $ | (230) | | | $ | 275 | | | $ | (274) | | | $ | 589 | |

| Less: | | | | | | | |

| Interest expense, net | (102) | | | (70) | | | (235) | | | (226) | |

| Income tax benefit (expense) | 76 | | | (29) | | | 99 | | | (118) | |

| Depreciation, depletion and amortization | (235) | | | (249) | | | (693) | | | (738) | |

| Total EBITDA | 31 | | | 623 | | | 555 | | | 1,671 | |

| Less: | | | | | | | |

EBITDA of noncontrolling interests1 | 20 | | | 20 | | | 56 | | | 60 | |

Weirton indefinite idle2 | (2) | | | — | | | (219) | | | — | |

| Loss on extinguishment of debt | — | | | — | | | (27) | | | — | |

| Acquisition-related costs | (14) | | | (3) | | | (14) | | | (5) | |

| Changes in fair value of foreign currency contracts, net | (7) | | | — | | | (7) | | | — | |

| Arbitration decision | (71) | | | — | | | (71) | | | — | |

| Other, net | (19) | | | (8) | | | (24) | | | (16) | |

| Total Adjusted EBITDA | $ | 124 | | | $ | 614 | | | $ | 861 | | | $ | 1,632 | |

| | | | | | | |

1 EBITDA of noncontrolling interests includes the following: |

| Net income attributable to noncontrolling interests | $ | 12 | | | $ | 11 | | | $ | 33 | | | $ | 35 | |

| Depreciation, depletion and amortization | 8 | | | 9 | | | 23 | | | 25 | |

| EBITDA of noncontrolling interests | $ | 20 | | | $ | 20 | | | $ | 56 | | | $ | 60 | |

| | | | | | | |

2 Refer to NOTE 2 - SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION for further information. |

The following table summarizes our depreciation, depletion and amortization and capital additions by segment:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Depreciation, depletion and amortization: | | | | | | | |

| Steelmaking | $ | (228) | | | $ | (241) | | | $ | (669) | | | $ | (711) | |

| Other Businesses | (7) | | | (8) | | | (24) | | | (27) | |

| Total depreciation, depletion and amortization | $ | (235) | | | $ | (249) | | | $ | (693) | | | $ | (738) | |

| | | | | | | |

Capital additions1: | | | | | | | |

| Steelmaking | $ | 211 | | | $ | 217 | | | $ | 554 | | | $ | 503 | |

| Other Businesses | — | | | — | | | 3 | | | 3 | |

| Corporate | — | | | 1 | | | — | | | 2 | |

| Total capital additions | $ | 211 | | | $ | 218 | | | $ | 557 | | | $ | 508 | |

| | | | | | | |

1 Refer to NOTE 2 - SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION for additional information. |

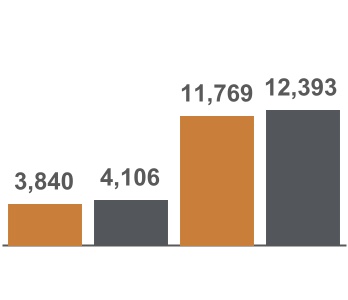

The following summarizes our assets by segment:

| | | | | | | | | | | |

| (In millions) | September 30,

2024 | | December 31,

2023 |

| Assets: | | | |

| Steelmaking | $ | 16,235 | | | $ | 16,880 | |

| Other Businesses | 637 | | | 657 | |

| Intersegment eliminations | (489) | | | (507) | |

| Total segment assets | 16,383 | | | 17,030 | |

| Corporate | 413 | | | 507 | |

| Total assets | $ | 16,796 | | | $ | 17,537 | |

NOTE 5 - PROPERTY, PLANT AND EQUIPMENT

The following table indicates the carrying value of each of the major classes of our depreciable assets:

| | | | | | | | | | | |

| (In millions) | September 30,

2024 | | December 31,

2023 |

| Land, land improvements and mineral rights | $ | 1,389 | | | $ | 1,389 | |

| Buildings | 938 | | | 946 | |

| Equipment | 9,916 | | | 9,680 | |

| Other | 315 | | | 302 | |

| Construction in progress | 714 | | | 590 | |

Total property, plant and equipment1 | 13,272 | | | 12,907 | |

| Allowance for depreciation and depletion | (4,585) | | | (4,012) | |

| Property, plant and equipment, net | $ | 8,687 | | | $ | 8,895 | |

| | | |

1 Includes right-of-use assets related to finance leases of $358 million and $306 million as of September 30, 2024 and December 31, 2023, respectively. |

We recorded depreciation and depletion expense of $233 million and $687 million for the three and nine months ended September 30, 2024, respectively, and $247 million and $732 million for the three and nine months ended September 30, 2023, respectively.

During the first quarter of 2024, we announced the indefinite idle of our Weirton tinplate production plant, which resulted in a $46 million impairment charge to Property, plant and equipment, net.

NOTE 6 - GOODWILL AND INTANGIBLE ASSETS AND LIABILITIES

GOODWILL

The following is a summary of Goodwill by segment:

| | | | | | | | | | | |

| (In millions) | September 30,

2024 | | December 31,

2023 |

| Steelmaking | $ | 956 | | | $ | 956 | |

| Other Businesses | 49 | | | 49 | |

| Total goodwill | $ | 1,005 | | | $ | 1,005 | |

INTANGIBLE ASSETS AND LIABILITIES

The following is a summary of our intangible assets and liabilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| (In millions) | Gross Amount | | Accumulated Amortization | | Net Amount | | Gross Amount | | Accumulated Amortization | | Net Amount |

Intangible assets1: | | | | | | | | | | | |

| Customer relationships | $ | 90 | | | $ | (22) | | | $ | 68 | | | $ | 90 | | | $ | (18) | | | $ | 72 | |

| Developed technology | 60 | | | (17) | | | 43 | | | 60 | | | (14) | | | 46 | |

| Trade names and trademarks | 18 | | | (6) | | | 12 | | | 18 | | | (5) | | | 13 | |

| Mining permits | 72 | | | (28) | | | 44 | | | 72 | | | (28) | | | 44 | |

| Supplier relationships | 29 | | | (5) | | | 24 | | | 29 | | | (3) | | | 26 | |

| Total intangible assets | $ | 269 | | | $ | (78) | | | $ | 191 | | | $ | 269 | | | $ | (68) | | | $ | 201 | |

Intangible liabilities2: | | | | | | | | | | | |

| Above-market supply contracts | $ | (71) | | | $ | 28 | | | $ | (43) | | | $ | (71) | | | $ | 24 | | | $ | (47) | |

| | | | | | | | | | | |

1 Intangible assets are classified as Other non-current assets. Amortization related to mining permits is recognized in Cost of goods sold. Amortization of all other intangible assets is recognized in Selling, general and administrative expenses. |

2 Intangible liabilities are classified as Other non-current liabilities. Amortization of all intangible liabilities is recognized in Cost of goods sold. |

Amortization expense related to intangible assets was $3 million for both the three months ended September 30, 2024 and 2023, and $10 million for both the nine months ended September 30, 2024 and 2023. Estimated future amortization expense is $3 million for the remainder of 2024 and $13 million annually for the years 2025 through 2029.

Income from amortization related to the intangible liabilities was $1 million for both the three months ended September 30, 2024 and 2023, and $4 million for both the nine months ended September 30, 2024 and 2023. Estimated future income from amortization is $1 million for the remainder of 2024 and $5 million annually for the years 2025 through 2029.

NOTE 7 - DEBT AND CREDIT FACILITIES

The following represents a summary of our long-term debt:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) |

| Debt Instrument | | Issuer1 | | Annual Effective

Interest Rate | | September 30,

2024 | | December 31,

2023 |

| Senior Secured Notes: | | | | | | | | |

6.750% 2026 Senior Secured Notes | | Cliffs | | 6.990% | | $ | — | | | $ | 829 | |

| Senior Unsecured Notes: | | | | | | | | |

7.000% 2027 Senior Notes | | Cliffs | | 9.240% | | 73 | | | 73 | |

7.000% 2027 AK Senior Notes | | AK Steel | | 9.240% | | 56 | | | 56 | |

5.875% 2027 Senior Notes | | Cliffs | | 6.490% | | 556 | | | 556 | |

4.625% 2029 Senior Notes | | Cliffs | | 4.625% | | 368 | | | 368 | |

6.750% 2030 Senior Notes | | Cliffs | | 6.750% | | 750 | | | 750 | |

4.875% 2031 Senior Notes | | Cliffs | | 4.875% | | 325 | | | 325 | |

7.000% 2032 Senior Notes | | Cliffs | | 7.054% | | 1,425 | | | — | |

6.250% 2040 Senior Notes | | Cliffs | | 6.340% | | 235 | | | 235 | |

| ABL Facility | | Cliffs2 | | Variable3 | | 47 | | | — | |

| Total principal amount | | | | | | 3,835 | | | 3,192 | |

| Unamortized discounts and issuance costs | | | | | | (61) | | | (55) | |

| Total long-term debt | | | | | | $ | 3,774 | | | $ | 3,137 | |

| | | | | | | | |

1 Unless otherwise noted, references in this column and throughout this NOTE 7 - DEBT AND CREDIT FACILITIES to "Cliffs" are to Cleveland-Cliffs Inc., and references to "AK Steel" are to AK Steel Corporation (n/k/a Cleveland-Cliffs Steel Corporation). |

2 Refers to Cleveland-Cliffs Inc. as borrower under our ABL Facility. |

3 Our ABL Facility annual effective interest rate was 8.25% as of September 30, 2024. Any incremental borrowings on our ABL Facility, as of September 30, 2024, would have had an interest rate between 5.63% and 8.25%. |

7.000% 2032 SENIOR NOTES OFFERING

On March 18, 2024, we entered into an indenture among Cliffs, the guarantors party thereto and U.S. Bank Trust Company, National Association, as trustee, relating to the issuance of $825 million aggregate principal amount of our 7.000% 2032 Senior Notes, which were issued at par. The 7.000% 2032 Senior Notes were issued in a private placement transaction exempt from the registration requirements of the Securities Act.

On August 16, 2024, we issued an additional $600 million aggregate principal amount of our 7.000% 2032 Senior Notes in a private placement transaction exempt from the registration requirements of the Securities Act. These additional notes were issued at a price of 99.25% of their principal amount. Furthermore, the additional notes are treated as the same class and series as the initial notes issued on March 18, 2024, other than with respect to the date of issuance and issue price. The net proceeds from the transaction were used to finance a portion of the cash consideration paid in connection with the Stelco Acquisition, which we completed on November 1, 2024.

The 7.000% 2032 Senior Notes bear interest at a rate of 7.000% per annum, payable semi-annually in arrears on March 15 and September 15 of each year, commencing on September 15, 2024. The 7.000% 2032 Senior Notes mature on March 15, 2032.

The 7.000% 2032 Senior Notes are unsecured senior obligations and rank equally in right of payment with all of our existing and future unsecured and unsubordinated indebtedness. The 7.000% 2032 Senior Notes are guaranteed on a senior unsecured basis by our material direct and indirect wholly owned domestic subsidiaries. The 7.000% 2032 Senior Notes are structurally subordinated to all existing and future indebtedness and other liabilities of our subsidiaries that do not guarantee the 7.000% 2032 Senior Notes.